All the Single Ladies...Are Buying Homes

Are you next?

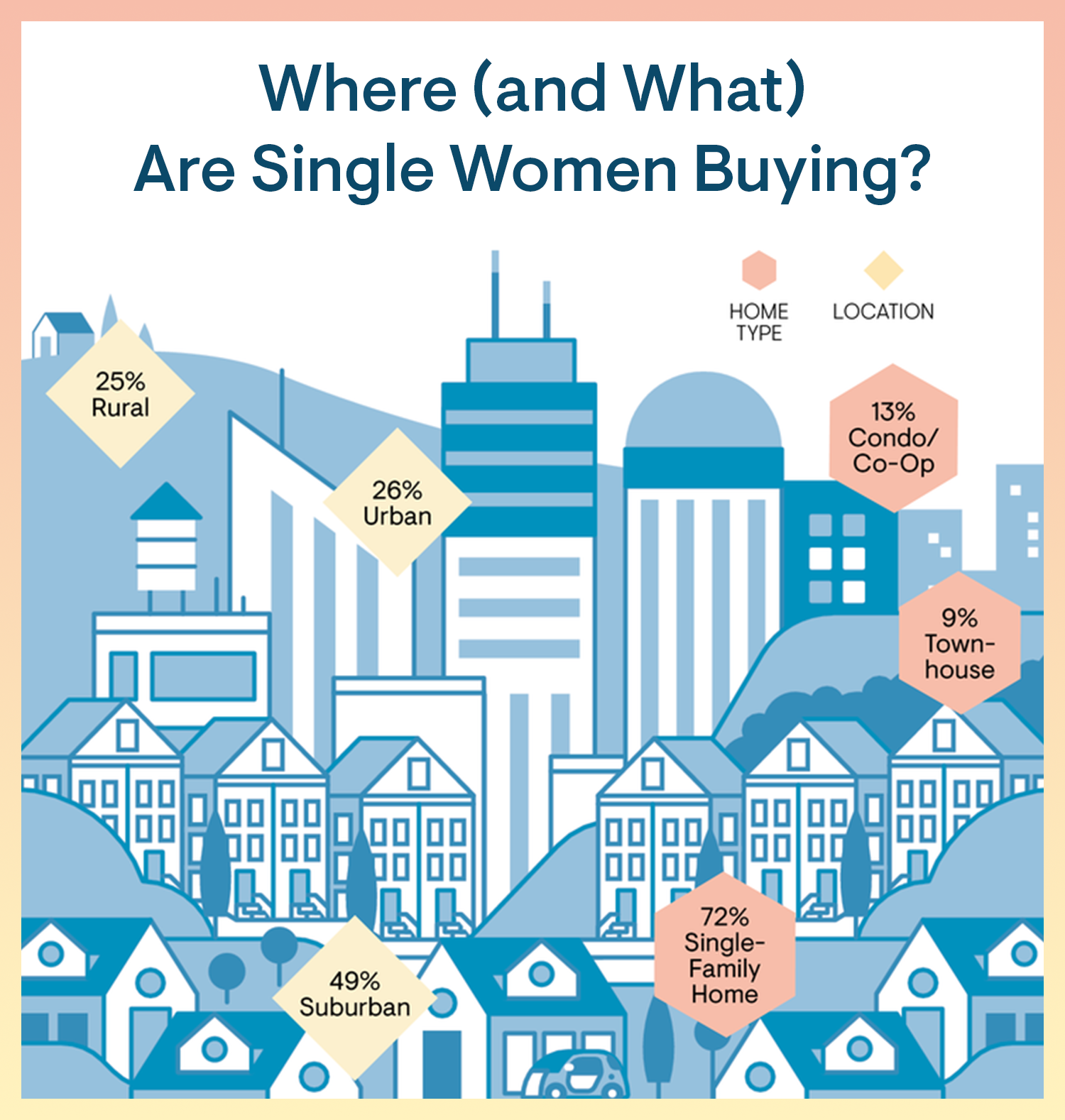

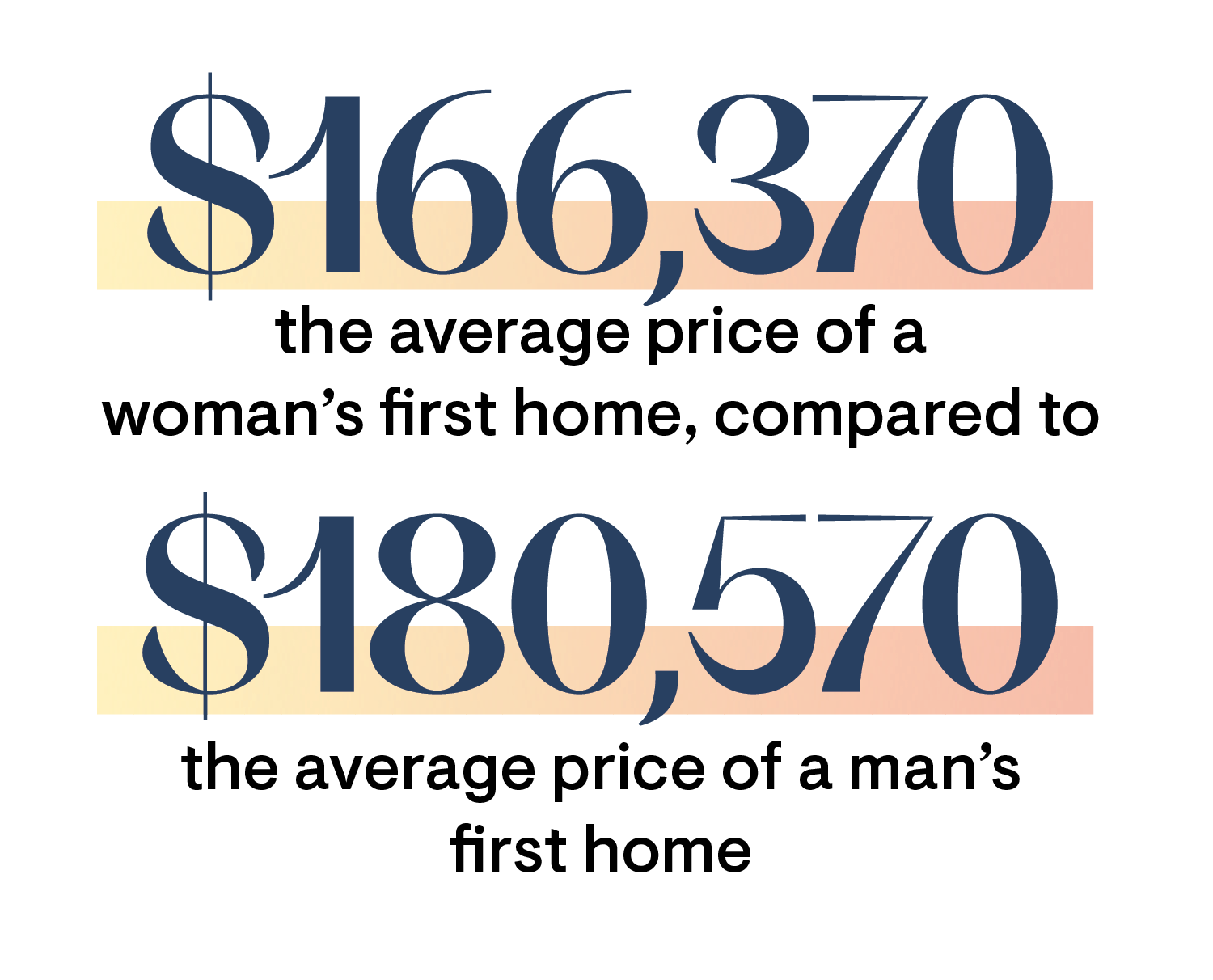

Solo home ownership? It’s for the girls. Despite the fact that we still make, on average, 80 cents to our male coworkers’ dollar, single women far outpace their male counterparts in purchasing homes. A rising demographic since the 1980s, single women made up 17 percent of home buyers last year. (Their single male counterparts accounted for around 9 percent.) They are one of the fastest-growing groups of homeowners today.

There’s plenty of evidence that this stems from choice: One 2018 report by Bank of America found that 73 percent of women value home ownership above getting married and having children, compared with 65 percent of men. It’s worth noting that men are incarcerated at nine times the rate women are, leaving, quite simply, fewer of them as possible buyers in their demographics.

Intrigued by this, Marie Claire and House Beautiful spent the past six months talking to women who own their own home across the country, including through an original survey of single female homeowners that explores what, how, and why single ladies are buying now.

Who Are These Women?

To oversimplify it: All women. Marie Claire and House Beautiful surveyed a demographically representative sample of American women between 18 and 60 years old and found that 17 percent of them had purchased a home without a spouse or romantic partner. Perhaps that has to do with our current employment status. Today, there are more women in the workplace than ever before. And they're buying homes no matter their salary. Twenty-eight percent of single female homeowners in our survey—the highest faction—reported earnings of between $25,000 and $49,999 a year, while 20 percent make $50,000 to $74,999 and just 2 percent bring home more than $200,000.

They also range in age. According to the National Association of Realtors, the median age of today’s single female home buyer is 54, indicating a swell of boomers buying alone, either as divorcées or having never been married. But there’s also a healthy group on the younger end of the age spectrum that’s choosing to enter home ownership solo for the first time—34 percent of our survey-takers purchased their place when they were between ages 18 and 29; 40 percent between 30 and 39.

This younger group of women have been subject to much analysis—and, it’s fair to say, more than a little public hand-wringing. They're from a generation where marriage is happening later and later, if at all. The disparity in single female and male home ownership within this age group suggests that women, unlike their male peers, aren’t waiting for marriage (or even partnership) to buy a home.

Changing the Fairytale

For many women, the decision to purchase a house means dispelling a mysteriously still-prevalent notion that doing so should come after love and marriage.

“To be honest, I might have thought at this point, in my late 20s, I’d be making a decision about buying my first place with someone,” recalls 34 year-old Jemea Goso of the decision to purchase her first home in D.C. five years ago. “I didn’t feel bad about it at all, I kind of just had to rethink my game plan.”

When Rebecca Scholand was looking to buy a home in New Hampshire three years ago, she was dating someone—but regardless, “it was definitely my house,” she says. “I went into it with the mindset of this was 100-percent my house, and when he was there”—her boyfriend at the time worked as a climbing guide, so was often traveling—“he paid me rent.”

Since then, Scholand has become engaged, and her fiancé lives in the home she bought, as do his two daughters. But she remains glad she made the decision to purchase on her own.

Planning for the Future

It’s that same sense of preparedness that drove Tia Bennett to purchase a home on her own in Riverdale Park, Maryland, just outside of Washington, D.C. “When I think back to my 20s and early 30s, the ideal was finding a Prince Charming, getting married, starting a family, and living happily ever after,” says Bennett. “Honestly, I held off on buying a home because, just like many women, I thought I’d have [the fairytale] first, then go into homeownership with my spouse. But that never happened—and then time just starts passing you by. So when I hit my mid- to late-30s I decided to create my own happy ending.”

Another factor in her decision? The prospect of motherhood. “I am considering becoming a choice mom, and I wanted to have something that was my own,” says Bennett, who froze her eggs shortly before closing on her home last year. “I wanted someplace that was stable, where I could raise a child. The reality is, I’m not alone. In today’s society more women in their late-30s and early-40s are opting to make their dreams reality on their own without a mate.”

Jessica Lautz, vice president of demographics and behavioral insights for the National Association of Realtors, points to the act of caregiving as a significant factor for single women buying homes. Indeed, according to the Pew Research Center, some 21 percent of children live with single mothers, compared to just 4 percent with single fathers. “Even if she doesn’t have young children, she likely is a caregiver in another way,” Lautz explains. “Maybe she has children over 18 who still live with her, or maybe she’s caring for an older parent.”

Managing Money

Of course, women's specific reasons for buying a home are as varied as the home styles and prices available, but money is a huge factor. Thirty-one percent of survey respondents listed their reason for buying as “I’m making enough to afford a mortgage on my own;” 29 percent cited the favorable market; 26 percent said that “real estate is always a good investment,” while 15 percent bought their own place after a breakup or divorce.

“For me, it was a combination of wanting an investment and knowing that, when I did the calculations, for me to rent a nicer apartment would have cost me what a mortgage would cost,” explains Alexa Klorman, who closed on her one-bedroom apartment in Manhattan in December 2018.

Nikki Merkerson purchased her first home solo at age 29, then rented it out because she couldn’t afford to live in it—but she still wanted to be an owner. She then went on to found Pair Gap, a hub for collaborative buying, to encourage more young people—male and female—to buy homes earlier.

“Don’t think of it in the traditional way: When I get married and have kids, I’ll buy a house,” she says. “Think of it as an investment opportunity and a way of not starting your life in the negatives. Now, millennials are starting their lives $30,000-plus in debt. If they’re renting, they should consider buying. And if they can’t do it themselves, get with friends, buy something together, and build wealth early.”

“A lot of people think they can’t afford to buy,” Merkerson says. “But if you’re renting right now, you’re paying a mortgage—it’s just not yours.”

As Jamie Chappell, who just closed on a home in the San Francisco area, points out, your first investment doesn’t have to be your forever home. “A lot of my friends will say, ‘I want to own a home but I like my freedom,’” says Chappell. “One friend said to me, ‘It doesn’t have to be forever.’ And that really stuck with me.”

Getting Responsible

With ownership, of course, comes added responsibility—a reality that every woman we spoke to was acutely aware of. “The other day a friend called me and said, ‘Are you home?’ I was like, ‘No—why, is it on fire?’” recalls Nzinga Young, nervous about being responsible for the New Jersey home she bought last year. Young is also a landlord, renting out part of the home to subsidize the mortgage, which adds extra pressure. “There’s a level of responsibility that comes with ensuring another family is comfortable in the home,” she says.

Of our survey responders, 30 percent cited being able to afford the mortgage alone as the biggest source of nervousness about the process, while 24 percent said they were most worried about “taking on the responsibilities of repairs/renovations alone.”

But still, every interviewee spoke of the sense of pride and accomplishment that came out of their purchase. “It’s like an extension of my person at this point,” says Emily Palen, who bought her Lewisburg, PA, home in 2016 at age 24. “When something goes wrong with the house it affects me in a lot of ways. It’s mine and I want to make it okay, and it’s my shelter and my project. So it’s definitely emotional, but most of the time in a really good way.”

Says Klorman, following her one-bedroom purchase (which was followed by an extremely extensive gut renovation), “Sometimes I look around and I’m like, I can’t believe I pulled this off. And with the added layer that the money I used came from a business I built. Sometimes I pause and just think, ‘This is crazy.’”

Researching in Advance

For those willing to put in the work, buying a home is clearly not crazy. It’s just about finding reliable sources—and having the time to do so. “There is no shortage of information,” says Scholand, who took mortgage classes provided by QuickenLoans online (the company's extensive resources were one reason she chose a mortgage with them).

“I think money is such a taboo topic that there’s so much you don’t learn,” says Casey Miller, who bought her first home in Detroit in 2013. “It’s a great opportunity to have really honest conversations with friends and family members.” Miller, like many of her fellow interviewees, says she found much of her information online.

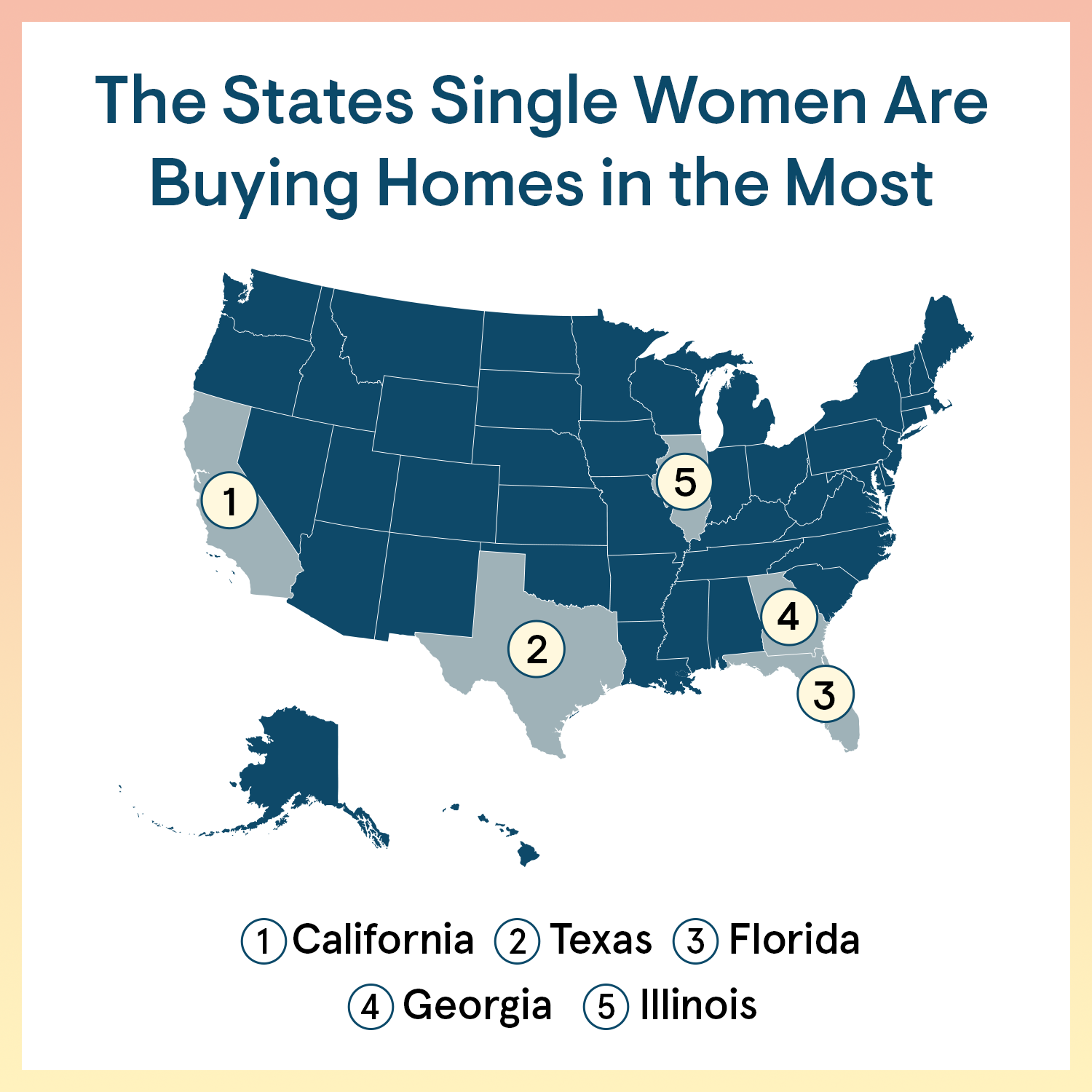

“You have to do your research, have your finances together,” says Carmelita Pickett, who has owned homes in Texas, Virginia, and Georgia. She’s one of several people interviewed who cautioned prospective buyers to be aware of hidden money sucks besides the down payment and mortgage itself, like closing costs and inspection fees. “I never considered that at my closing, I’d have to buy whatever fuel was left over in the tank,” laughs Scholand.

The biggest takeaway for many of our interviewees? It’s never too early to start planning. “Our favorite clients are the people who come to us two years out and want us to help them save, help them prepare,” says Danielle Lurie, founder of an all-female realty team at Compass that empowers women to buy early.

Beyond understanding your own finances, there are a wide range of mortgage, loan, and assistance options worth investigating before you begin your search. Homeowner Beth Diana Smith received a $5,000 grant from her New Jersey town to buy her first place, and Palen was eligible for a Veterans United mortgage thanks to her stepfather’s military service. Through a well-researched combination of loans and assistance programs, Nasozi Kakembo put down just $0.73 at her home’s closing.

There's also the power of negotiation. Research shows women consistently aim lower than their male counterparts when it comes to things like asking for raises—and are more likely to underestimate their own skills, performance, and worth. “Sometimes women undervalue themselves,” says Lurie. “So we really try to empower them to negotiate if they can. Sometimes they can’t. But if we can, we want to push.”

The New Normal

So what does the future look like for this growing demographic? “I think what we’re going to see in the future is more single people overall—females, males, unmarried couples,” says Lautz. “It doesn’t matter if you’re married; you want a place of your own. Whether that’s with roommates, a partner...people are going to be making the biggest financial decision of their life without a wedding ring.”

If you like it, we should say, then put a down payment on it.

-

My Husband Left Me After 16 Years—So I Bought a Fixer Upper Across the Country

"This house could hold me. It had survived being abandoned, too."

By Danelle Lejeune Published

-

How to Buy a Home

How To From getting your finances in order to popping that champagne.

By Brittany Anas Published

How To -

Home Decor Ideas for Women Who Just Bought Their Own Place

How To #TFW nobody can judge your choice in bath towels.

By Rachel Epstein Published

How To -

How to Afford a Home

How To There are a lot of loan programs and grants—especially for first-time buyers.

By Brittany Anas Published

How To -

All the Hidden Costs of Buying a Home

Features Read this to ensure your dream home is actually within your budget.

By Anni Irish Published

Features -

Spotlighting 3 Power Women in the Home Market

They’re changing how we think of and shop for a place to live.

By Ashley Edwards Walker Published