Will Money Destroy Your Marriage?

Secret bank accounts, hidden documents, foreclosure notices — women across the country are uncovering shocking signs of financial infidelity.

An award-winning performing arts professional, Joni Robbins* had two kids, a spacious Manhattan apartment, and a successful production company built around her creative collaboration with her husband. Their glamorous, fast-paced life was the envy of her friends — until the night Robbins took the dog out and grabbed her husband's jacket instead of her own.

The coat felt strangely heavy and stiff, and when Robbins looked inside, she discovered the lining had been cut open and stuffed with mail. "Out of this jacket comes somebody else's financial nightmare, except that my name was all over it: years and years of liens, warrants, tax notices, eviction notices, repossession notices, tuition overdue notices, health insurance cancellation — we hadn't had health insurance in eight months, and we were about to be evicted from our apartment," she says. "We were three weeks away from living out in the park. It was horrifying."

When she confronted her husband, he offered no explanation. "He shut down completely," she says.

Throughout their 13-year relationship, Robbins had managed their corporate business while her husband handled their personal finances. But while she signed their tax returns every year, he apparently never filed them. "I had no idea I wasn't paying taxes," she says.

Robbins eventually learned that their debts exceeded $750,000. She insisted they go into therapy, but a few months later her husband abruptly left her, and she found he had been having an affair. Robbins is now getting a divorce, negotiating with the IRS, and struggling to make sense of what happened.

"My life as I perceived it wasn't my life," she says. "All I thought we had and were wasn't true at all."

Robbins still can't get over the fact that her husband never shared their financial troubles or let her help deal with them, a choice that left her feeling deeply betrayed. That reaction is a telling sign of the times; in previous eras, wives often had very different expectations. Back when everyone assumed that men made the money and the decisions, women didn't necessarily believe they were entitled to share information, let alone power. But today, marriage is typically viewed as a partnership based on mutual trust, and when one partner violates that trust by keeping financial secrets, lying, or making unilateral decisions that threaten a family's welfare, the other partner can feel profoundly betrayed by a transgression that may be even more destabilizing than an affair.

Stay In The Know

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Such betrayals became increasingly visible during the last couple of years as the recession forced financial problems out into the open and people's debts caught up with them. The latest data shows that financial infidelity is rampant. A survey by the nonprofit CESI Debt Solutions revealed that 80 percent of spouses spend money their partners don't know about, and more than two-thirds of the respondents had had a relationship affected by financial dishonesty. Another study, commissioned by the National Endowment for Financial Education (NEFE) and Forbes Woman, found that three in 10 Americans admit to financial deception with their partners. Of those, nearly 60 percent had hidden cash; more than half had hidden purchases; an additional 30 percent had hidden statements or bills; and 34 percent said they lied about finances, debt, or money earned.

Women are victimized more often than men: According to the NEFE study, 65 percent of women said their partners had lied to them about finances or debt, compared with 47 percent of men. Among those who were deceived, more than 40 percent said it damaged the trust in their relationship, and for 16 percent it resulted in divorce.

"Money is this massive pink elephant in bedrooms all across America, and the problem has been heightened in the economic downturn, which is a painful backdrop for dealing with an issue that nobody wants to talk about," says Manisha Thakor, a personal finance expert and author of Get Financially Naked: How to Talk Money With Your Honey.

The reasons for financial infidelity can vary. Some men conceal financial assets because they're secretly preparing to leave their wives, while others lie to their partners even as they remain committed to the relationship and expect it to survive.

Ann Hopkins* thought she and her husband had a wonderful marriage. "He was my best friend," says Hopkins, a stay-at-home mother who raised their two children in an affluent suburb in the Northeast.

Then one day her husband, a successful corporate executive, came home and delivered some unbelievable news. "I thought we had a few million dollars, but he said, 'We have nothing left,'" Hopkins reports.

Her husband had gambled away everything they owned on bad investments and unsuccessful day-trading. "Not only had he lost everything, but we were $240,000 in debt, including student loans I didn't know he had taken out to get our kids through college," Hopkins says. "I went to see a lawyer, and she said, 'Face it — you are destitute.'"

They sold their house and separated, although they did not divorce. Today, Hopkins lives alone in a room she rents from a friend, and she works for an event-planning company. "I have nothing — no pension, no equity, no nothing," she says. "I don't even have a place where my kids can come and stay with me on holidays. We have learned to be poor, but there isn't a day that I wake up and am not afraid. There's tons of grief. I lost my whole life."

But she knows she isn't the only one. "One friend was home during the day when she heard a rattling at the front door — and found that a person was putting a foreclosure notice on her house," Hopkins says. "Another friend's husband lost even more than my husband did. It's ego and arrogance. These men think, I can make this money back. I'll fix it, and she'll never know. There's huge denial. My husband still thinks we'll get back together. But I trust virtually no one now. You can't trust anybody."

Alison Stein* had no idea she couldn't trust her husband until he was suddenly asked to resign as treasurer of the cooperative summer community where they owned a country cottage in upstate New York. When the community accounts revealed a financial shortfall, Stein's husband admitted to having taken the money; he and Stein had just adopted a baby, and he claimed he had borrowed the funds to cover the costs of adoption.

"I said, 'That doesn't make sense — we took out a loan from the bank to pay for the adoption,'" recalls Stein, a teacher. "I remember feeling so sick to my stomach — that churning feeling that your whole world is caving in around you. It was the most dreadful feeling."

Her husband turned out to have stolen around $40,000 from the account — and to have been leading a high-rolling secret life. "I was living in a one-bedroom apartment in the Bronx, with furniture that needed to be re-covered, and he was spending thousands of dollars wining and dining other women while telling me he had to work late," Stein says.

The embezzlement could have resulted in criminal charges, but the cooperative's officials knew that Stein might lose her new daughter if her husband were indicted, so they offered to keep the theft private if he repaid the money. But his debts proved to be much more extensive. When his credit card tab and other liabilities were tallied, "The whole package was a little more than $100,000," Stein says. "I never would have believed he was capable of doing what he did." She ended up paying off his debt by herself.

No matter what the circumstances, the emotional toll of such duplicity can be life-altering. "There is no such thing as an innocent financial fib," says relationship therapist Bonnie Eaker Weil, the author of Financial Infidelity. "Secrets destroy intimacy, and anyone who is hiding money is also hiding their feelings. They may not think they're doing anything wrong, but they're used to being an 'I' instead of a 'we.'"

Weil compares financial infidelity to sexual infidelity, in motive as well as effect. "A lot of people get off on this — they get the same thrill-seeking, self-medicating, stress-busting high," she says. "It's a form of gambling."

But while one partner is clearly the perpetrator, Weil believes that both need to re-evaluate their behavior. "It's just like with adultery. Most of the time, two people unconsciously collude to commit financial infidelity," she says. "The person it happened to hasn't been minding the store; there were red flags, but she was in denial. There's magical thinking on both parts."

Many women are shocked to discover their own legal vulnerability as partners in a marriage, and some find they have unwittingly been implicated in serious crimes. Carol Ross Joynt, a former television producer, had been married for 20 years when her husband, a wealthy Washington restaurant-owner, died suddenly from pneumonia. Only then did she learn that he had cheated the IRS out of $3 million and was facing federal tax fraud charges —and that his death made her the defendant in the case.

"This was crazy. I hadn't done anything wrong. How could I be the defendant in anything?" Joynt wrote in her new book, Innocent Spouse: A Memoir.

But she had cosigned their tax returns, so the IRS assumed her complicity. Joynt's lawyers ultimately mounted a so-called innocent spouse defense, in which they described her willful cluelessness: "Throughout her adult life, Carol steadfastly avoided getting involved in financial matters because she knew they were complex and she did not understand them."

"I should have probed. I never did," Joynt wrote. "I didn't ask questions. I didn't insist on answers. I didn't want to know. It was marital don't ask, don't tell."

Such avoidance is all too common, according to financial advisers and matrimonial attorneys. "I'm disappointed in the percentage of women who are unaware of the family finances," says Leonard Ross, a Florida divorce lawyer. "They think they're never going to get divorced or separated, and they sign whatever documents their husbands put before them, and they don't have any idea of what their husbands are doing. Even very intelligent women will be ignorant about what their husbands actually earn, what their assets are, and what their futures really look like."

But when it comes to money, healthy relationships require candor and competence on both sides, according to the experts. "You have to have financial transparency," says Weil. In order to achieve that, couples need to establish responsible habits from the outset. "Before people commit to each other, they should get completely financially naked," says Thakor. "They should exchange a list of what they own and owe, their credit scores, what they earn and spend. You should sit down and discuss those items twice a year. If you do, you can ferret out problems before they become so large you need to hide."

The imperative is clear, she adds: "You have to deal with them before you have a foreclosure notice on the house."

*Names marked with an asterisk have been changed to protect the privacy of the families involved.

-

Travis Kelce's Mom Reportedly "Liked" a Comment About His Future as a Dad

Travis Kelce's Mom Reportedly "Liked" a Comment About His Future as a Dad...and then removed it.

By Lia Beck

-

Prince Louis Will Soon Be Allowed a Special Privilege That Prince George and Princess Charlotte Already Have

Prince Louis Will Soon Be Allowed a Special Privilege That Prince George and Princess Charlotte Already HaveThe youngest Wales child will turn 7 on April 23.

By Kristin Contino

-

$20 and 30 Minutes Is All You Need for a Vacation-Level Glow

$20 and 30 Minutes Is All You Need for a Vacation-Level GlowSelf-tanner secrets, according to a beauty director.

By Hannah Baxter

-

30 Female-Friendly Porn Websites for Any Mood

30 Female-Friendly Porn Websites for Any MoodFeatures All the best websites, right this way.

By Kayleigh Roberts

-

The 82 Best Cheap Date Ideas for Couples on a Budget

The 82 Best Cheap Date Ideas for Couples on a Budget"Love don't cost a thing." —J.Lo

By The Editors

-

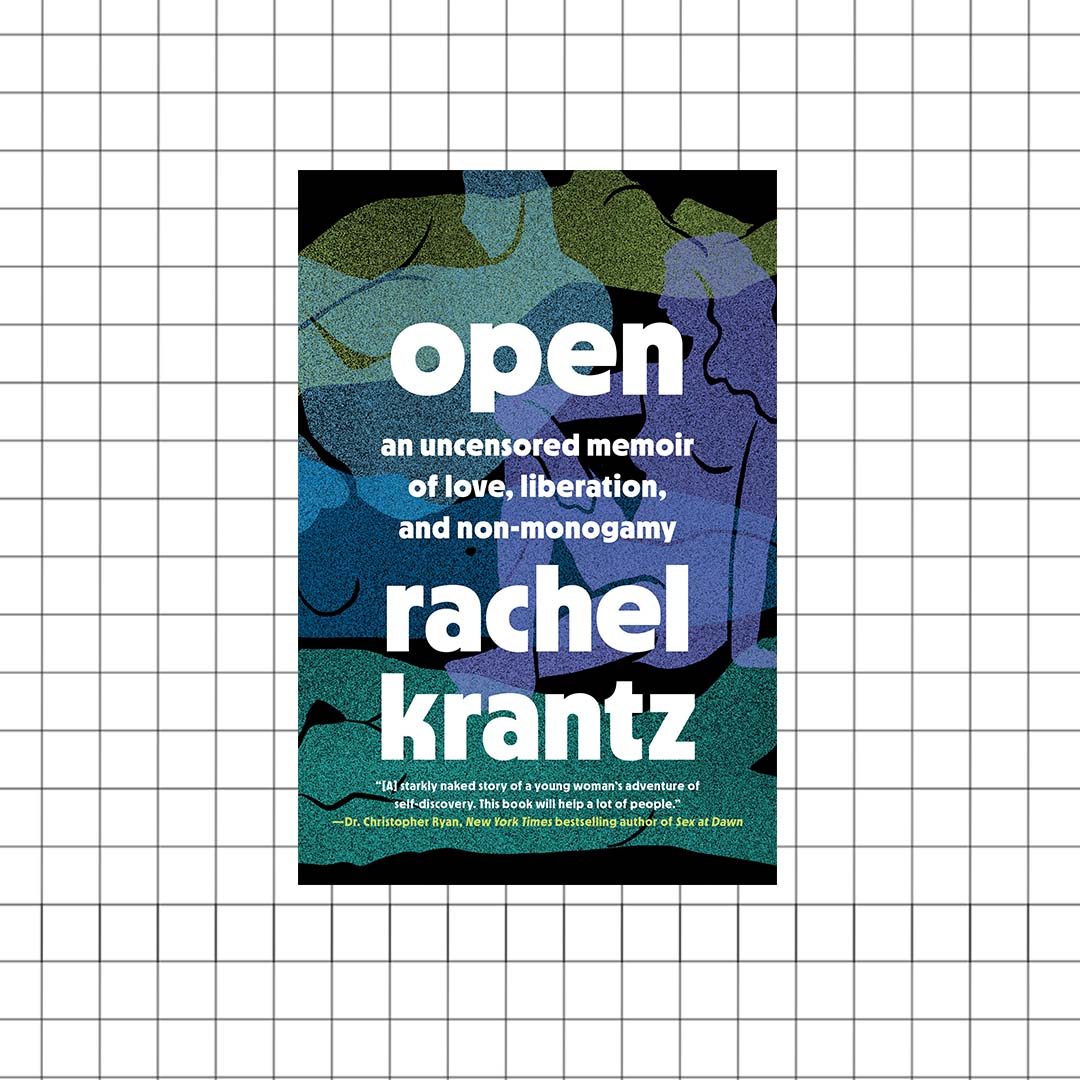

Diary of a Non-Monogamist

Diary of a Non-MonogamistRachel Krantz, author of the new book 'Open,' shares the ups and downs of her journey into the world of open relationships.

By Abigail Pesta

-

COVID Forced My Polyamorous Marriage to Become Monogamous

COVID Forced My Polyamorous Marriage to Become MonogamousFor Melanie LaForce, pandemic-induced social distancing guidelines meant she could no longer see men outside of her marriage. But monogamy didn't just change her relationship with her husband—it changed her relationship with herself.

By Melanie LaForce

-

COVID Uncoupling

COVID UncouplingHow the pandemic has mutated our most personal disunions.

By Gretchen Voss

-

16 At-Home Date Ideas When You're Stuck Indoors

16 At-Home Date Ideas When You're Stuck IndoorsFeatures Staying in doesn't have to be boring.

By Katherine J. Igoe

-

Long Distance Relationship Gift Ideas for Couples Who've Made It This Far

Long Distance Relationship Gift Ideas for Couples Who've Made It This FarAlexa, play "A Thousand Miles."

By Jaimie Potters

-

15 Couples on How 2020 Rocked Their Relationship

15 Couples on How 2020 Rocked Their RelationshipFeatures Couples confessed to Marie Claire how this year's many multi-stressors tested the limits of their love.

By Sherry Amatenstein, LCSW