Trump's Tariff Chaos Forces Women-Led Brands to Strategize and Adapt—Fast

The White House's sweeping new tariffs have shaken global markets and left retailers scrambling. Independent brands stand to lose the most.

Sali Christeson, founder and CEO of the women's workwear brand Argent, wasn't tuned in when President Trump unveiled his "Liberation Day" tariffs last Wednesday, April 2, but it didn't take long for the news to hit her text messages with the same jolt that shook the global stock market.

The executive tells me she spoke with at least twelve other founders, specializing in everything from casual wear to ballet flats, within the first day of the announcement. Internally, a "dark cloud" hung over her meetings with Argent's suppliers and team members. Christeson and her fellow business owners saw critical suppliers for their labels on the long list of countries subject to so-called reciprocal tariffs, including Vietnam, China, Cambodia, and European Union nations like Italy and France—and realized that business was about to become more challenging than ever.

"My conversations are all just like...what the f–ck?" Christeson says. "We really are a small community, especially female founders. We're constantly doing risk mitigation. That is our entire existence." Navigating the Trump administration's tariffs—a campaign trail threat framed as retaliation against other countries and "medicine" for the United States—has proven more difficult, with little advance warning and tangled global supply chains to reassess. "We're still getting our arms around it. The challenge right now is that so much is in flux that has very real implications for us from a business perspective."

The government should play a more productive role in our success. They should not take away from our ability to thrive.

Sali Christeson, founder of Argent

Brands like Argent—independent and women-led—stand to lose significantly as major fashion sourcing regions face extensive taxes whenever they go into effect. (The tariffs were initially set to hit on April 9, but President Trump announced a 90-day pause beyond a 10 percent baseline tax.) Remember, tariffs are paid by the importing company, not the country from which the goods originated. With the United States importing approximately 98 percent of clothing and 99 percent of shoes, according to the Business of Fashion, every corner of the industry will pay up in one way or another. Most likely, by raising prices for consumers, whether or not the designers want it to happen.

Rebekah Kondrat, managing partner of the retail expansion agency Rekon Retail, describes the tariffs as a "tipping point" for women-led brands. They may have been on a trajectory toward opening stores or expanding their audiences, but even the best indie brands lack the same margins as global powerhouses like Nike, Gap, or H&M. Multinational corporations have the flexibility to absorb tariffs before passing costs on to consumers or completely changing vendors. Decade-old shoe and handbag brands with a single storefront do not.

"Women-owned brands are already starting from a [disadvantage]: they don't get as much capital, they don't have as much clout with vendors," Kondrat explains. Before the tariffs, these labels were fighting for a mere two to three percent of all venture funding. Growth required effort, and every dollar mattered. Now, "These brands are going to be hit pretty hard because, of course, all the components, textiles, and everything come from a region that is heavily tariffed. This situation does not bode well for some of these more bootstrapped brands."

Unspun, a retail technology company creating 3D-woven denim and garments, specializes in localized production that's somewhat protected from tariffs. But globally-sourced materials to run its machines are still subject to costly taxes.

One brand stands out: Labucq, a footwear label known for its chunky boots and sculptural flats, all handcrafted in Tuscany, Italy. Their unique selling point—Italian heritage infused into founder Lauren Bucquet's aesthetic—now costs them a 20 percent tax on all European Union exports. She spent six to eight weeks exploring potential tariff outcomes with her team. While she believes the uncertainty was worse than the actual announcement, it nonetheless caused a fundamental shift in her brand. "It's existential. It changes absolutely everything," Bucquet states.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

A similar story is unfolding at M.M.LaFleur, where founder Sarah LaFleur states that one hundred percent of her products are made overseas. And at Freja, an emerging handbag brand with operations already so lean, founder Jenny Lei doesn't see any way to lower costs further. She hopes that planned launches of more premium items will make price increases seem worthwhile, since the value is rising along with the actual cost.

Adjusting to a timeline that founders didn't choose is neither easy nor welcome. "These were not costs we forecasted in our budget," LaFleur says. "With ample notice, these are changes we could have worked through. But the suddenness of it leaves very little room to maneuver except increasing prices and cutting costs."

Jenny Lei, founder of the celebrity-beloved bag brand Freja, hopes to frame tariffs like an opportunity to explore markets beyond the United States.

"I think the reality is sinking in now: we’ve built our entire model on something that isn’t resilient," says Beth Esponnette, co-founder and chief product officer of Unspun, a fashion manufacturing company that specializes in localized, 3D weaving technology. Unspun not only produces some of its own garments but also licenses its equipment to clients worldwide who are looking to reduce emissions and fabric waste. By design, it's less exposed to risk, yet it sources yarns and other components from abroad.

Esponnette explains that the even bigger issue is "how these tariffs impact the brands we partner with. In the past few weeks, we’ve had 15 brands, ranging from global giants to smaller independents, reach out to us asking how to diversify and mitigate risks in their manufacturing," she notes.

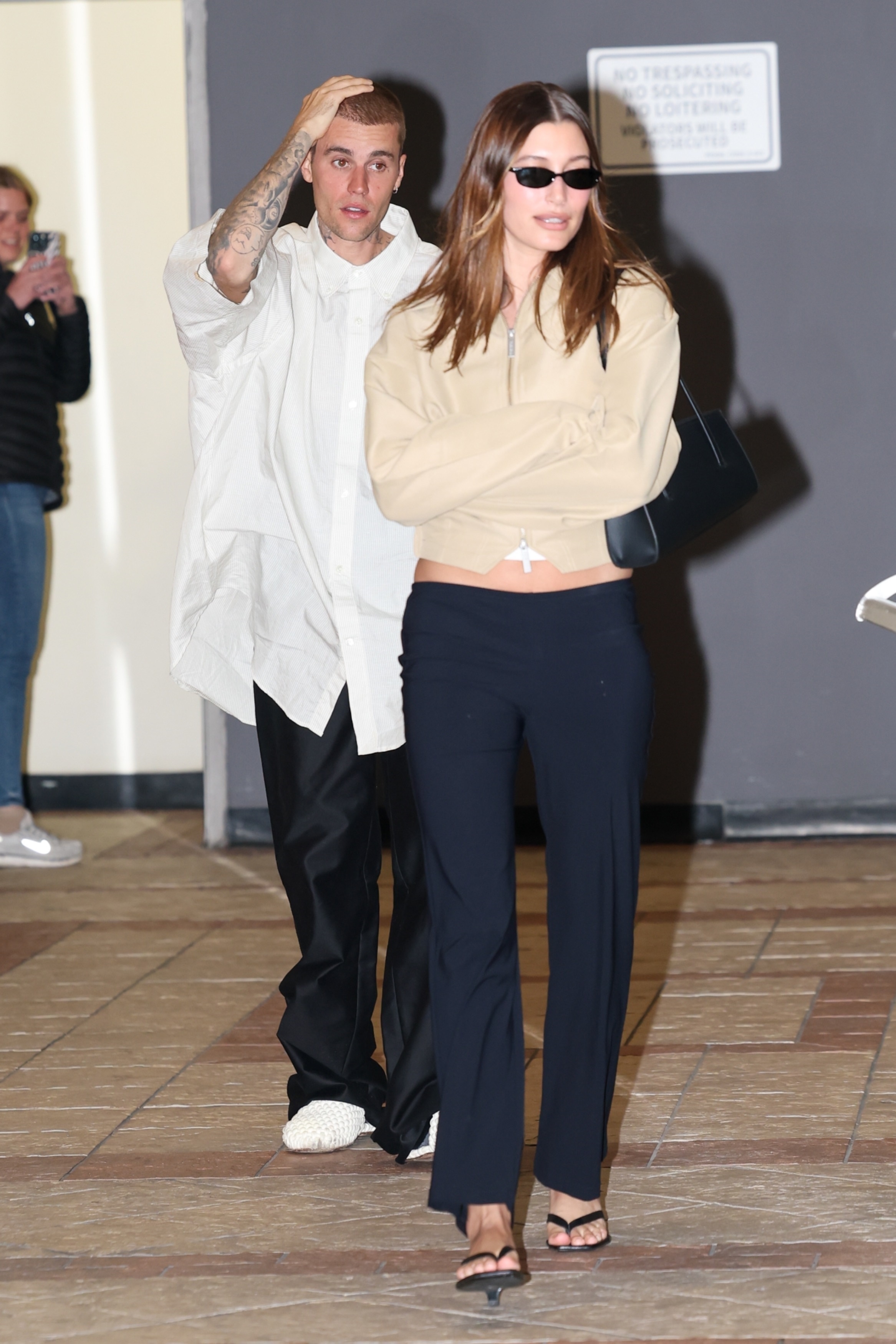

Every garment and accessory in this photo will be affected by tariffs.

One reason tariffs were introduced, according to the Trump administration, was to encourage more "Made in America" products. But adjusting to a new economic reality isn't as straightforward as moving production back to the United States. Workers must be trained, and facilities must be constructed. Many of the raw materials required for certain brands' standout products simply aren't sourced here. (For example, the silks used in some Argent blouses, which can only be produced in China.)

A number of labels cut and sew their pieces in workshops in New York City or Los Angeles, but they have no option other than to import the fabrics. Ergo, they're impacted by tariffs. That's the case with Argent, as Christeson says: "Maybe 40-50% of our business is American-made, so the fact that we are so severely impacted is really disheartening."

Adjusting to tariffs will hinder more than just the clothes' production; they'll affect the entire shopping experience. Kondrat states that clients are requesting store builds that exclusively source domestic production, but the components for shelving, fitting rooms, and clothing racks also have to come from somewhere. "Pretty much all lumber in the US comes from Canada, all mechanical components come from China, and a lot of textiles come from China," she explains. "You can't get away from it: Even if you do produce in the US, your raw components come from outside the US, so it is a little bit unavoidable. "If domestic manufacturing is the future, it will take a long time for a new footwear brand or manufacturer to catch up," Bucquet says. "The infrastructure in the US is just not set up to support it."

We’re being told to move production home, but no one’s giving us the tools to actually do it. We’ve done it with [electric vehicles], solar, and semiconductors, and subsidized the establishment of these industries, too—why is apparel always left behind?

Beth Esponnette, co-founder of Unspun

Brands as varied as Unspun (left) and M.M.LaFleur (right) will be forced to adapt their supply chains under new tariffs.

Nearly every business owner interviewed by Marie Claire expressed a sense of frustration about the entire situation. Countrywide, Christeson says, "It's all self-inflicted problems we'll face." Economists agree: The predicted recession heading for the United States this year could be a result of the new tariffs, according to Bloomberg.

In the aftermath, "My concern is that the burden is falling on brands—especially smaller ones who have the least margin to absorb extra costs," Esponnette says. "At the same time, there has been almost no investment from the government to support domestic manufacturing. We’re being told to move production home, but no one’s giving us the tools to actually do it. We’ve done it with EVs [electric vehicles], solar, and semiconductors, and subsidized the establishment of these industries, too—why is apparel always left behind?" Christeson also wondered why the government hadn't offered grants or sufficient warning to support new infrastructure if relocating apparel production to the United States was such a priority for the current administration.

A leather goods workshop in Ubrique, Spain, where bags crafted for a range of contemporary and luxury brands are now subjected to a 20 percent tariff.

Kondrat says the long-term effects on women-owned labels are still hard to predict. Given remaining uncertainty over how long tariffs would stay in effect—and a bipartisan proposal to axe them entirely—double the founders who participated in this article declined to comment on it. Similar to the COVID-19 crisis, there could be widespread layoffs and store closures as brands struggle to manage increasing costs. Nevertheless, every business owner and operator who spoke with Marie Claire agreed it's hardly time to throw in the towel.

"For me, it's a lot more about looking forward to seeing what opportunities lie ahead," Lei says. The United States is now Feja's biggest market, but international expansion has always been a priority for boosting profitability. Plus, the label has navigated tough times before, with a growing fanbase to show for it. "We survived our first year trying to sell a work bag in the midst of a global pandemic, and we will survive this," she says.

In a fast fashion, instant gratification-dominated market, gaining shopper support for one of the most immediate effects- higher prices- is a challenging endeavor. Bucquet states that her brand's followers have largely been supportive of her recent announcement. There have been complainers, too, but she brushes them off. "It’s not important to me how people feel about it, what’s important is how our market reacts to higher prices," she says, "and whether we can sustain a healthy business going forward."

Christeson sees a silver lining in the collective realization Americans are experiencing as they watch the news unfold. Finally, the general fashion public is beginning to understand how challenging it is to start, let alone maintain, a footwear or apparel brand. But that's not yet enough to outweigh the still-unknown effects of tariffs. It currently feels as though brands are being set up to fail. "The government should play a more productive role in our success. They should not take away from our ability to thrive. We're employing people, we're growing a company, we're bringing so much to our local and national economy," she says.

In an ideal world, her female founder group chat would focus more on upcoming collections and store expansions. "Never in my wildest dreams did I imagine that we would have to contend with decisions that are very detrimental to American businesses." For now, they're planning as best they can—and pushing forward together.

Editor's note: This story has been updated.

Halie LeSavage is the senior fashion news editor at Marie Claire, leading coverage of runway trends, emerging brands, style-meets-culture analysis, and celebrity style (especially Taylor Swift's). Her reporting ranges from profiles of beloved stylists, to exclusive red carpet interviews in her column, The Close-Up, to The A-List Edit, a newsletter where she tests celeb-approved trends IRL.

Halie has reported on style for eight years. Previously, she held fashion editor roles at Glamour, Morning Brew, and Harper’s Bazaar. She has been cited as a fashion expert in The Cut, CNN, Puck, Reuters, and more. In 2022, she earned the Hearst Spotlight Award for excellence in journalism. She holds a bachelor’s degree in English from Harvard College. For more, check out her Substack, Reliable Narrator.