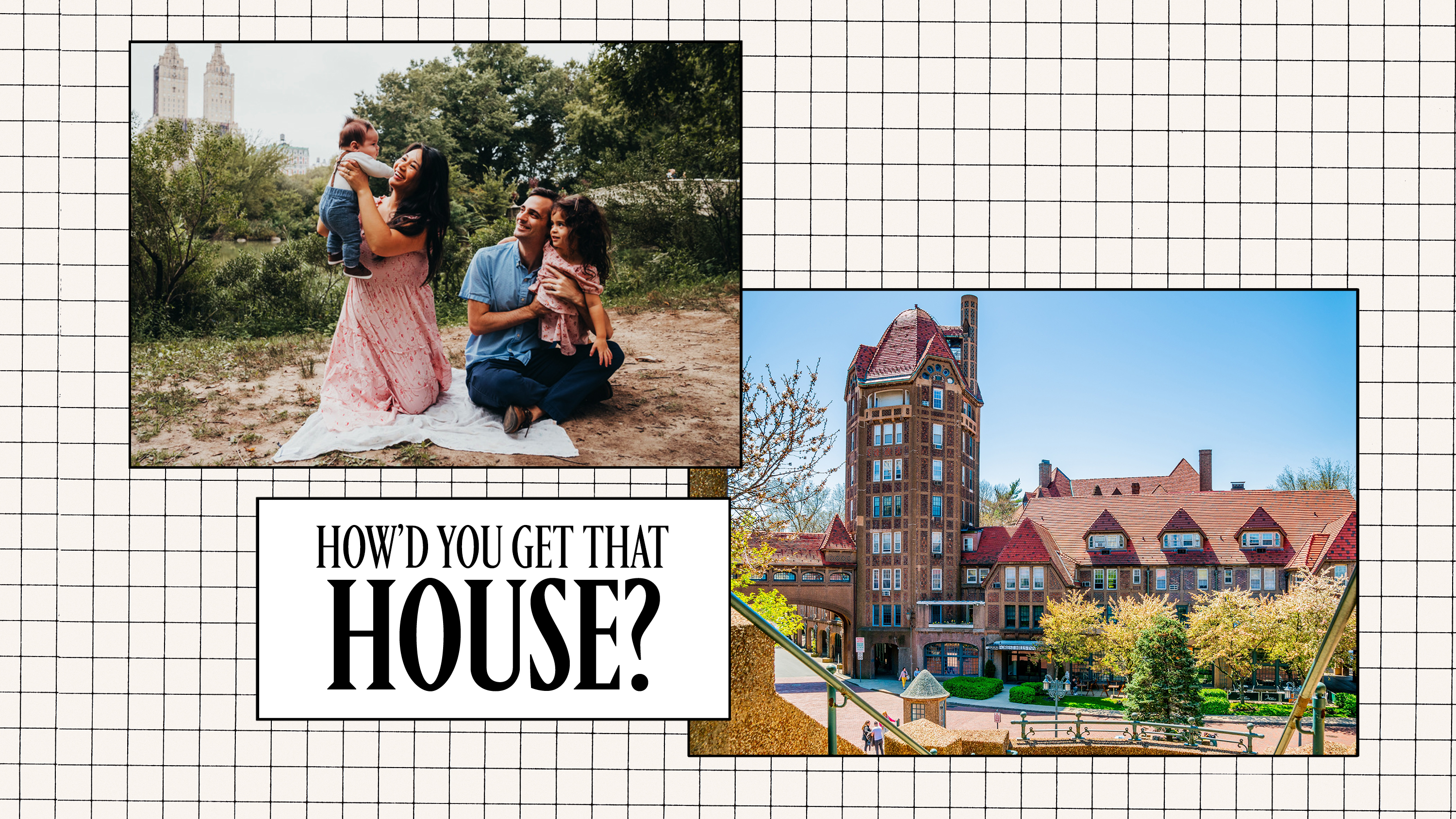

This NYC Marketing Director Used ChatGPT and Manifestation Techniques to Purchase a $900,000 Home 20 Mins From NYC

A cash gift from family for a down payment helped, too.

How’d You Get That House? speaks to people across the country who are navigating a complicated housing market. Here, a couple in their late 30s from Queens who recently came into money, but still felt squeamish about the nearly $1 million price tag for a historic fixer upper.

Larisa Courtien (interviewed here), a director of marketing at a reproduction tech start-up

Annual salary: about $185,000

Michael Courtien, a director of systems and sports financing at a sports and entertainment venue

Annual salary: roughly $150,000

A three-bedroom, 2.5 bath, 2,000-square-foot 1930s detached, single-family home with a fully-finished basement in Forest Hills, Queens, a suburb outside of New York City.

Initial budget: $800,000

Actual amount spent: $900,000

Down payment: $80,000

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Monthly mortgage: $6,000

The couple moved from a three-bedroom, 1.5 bath, 1,500-square-foot rental home in Forest Hills, Queens, a suburb outside of New York City.

“We were outgrowing our space. It was our pandemic home and served us well—it felt gigantic when we moved in; one friend even called it ‘cavernous’ when he visited. But after having our second child, we needed more room. My two-year-old had a significantly-smaller bedroom and the house only had one full bath, which made it hard to host my family who often visits from out of state. Also, I work from home, but only had a tiny corner in my bedroom. I needed an official office space.”

“We've lived in Forest Hills for four years and can’t imagine being anywhere else. The school system is one of the best in New York and we have made so many strong friendships here.

Skyrocketing prices in the area led us to believe that home ownership was just not going to be in the cards for us. But after seeing some of our peers buy around here, and knowing their salaries and their general monthly income and expenses, my husband and I revisited the idea.

I was also given the “I AM” manifestation journal, which introduced me to the law of attraction, and the “I Am a Mom Boss“ book that talks about mindset and how you need to be open to possibilities and not set in your ‘predetermined story.’ Once I realized I needed to be more open about home ownership, I started writing, We own a beautiful home in Forest Hills. A big part of manifesting is writing something as if it has already happened. Suddenly things started moving.

I looked for money in places I didn’t realize I could look, like retirement accounts with minimal penalty for taking out funds, and because we were more open, my husband's family shared they would contribute financially.

After three months of looking at online listings, we toured three houses. In November, we saw a home on a Monday and had an accepted offer by Friday. The inspection showed that unfortunately it needed more work than we could handle. There was evidence of brown mold.

A week later we saw two more homes. We put in an offer for both—I actually used ChatGPT to write the offer letter—and got one accepted offer.”

“I married someone who luckily has generational wealth. We pulled 50 percent of our down payment from our retirement accounts and savings, and the other 50 percent came generously as a combination of an inheritance and a cash gift from his family. I felt a little guilty, but overall so grateful. Without that generosity, owning a home in this neighborhood of New York City, where my in-laws have lived for years, would not be possible. There is a ton of privilege in our story, but I think that is how home ownership is—family is always helping. Not that many people acknowledge it. But receiving the money was definitely eye-opening about how difficult it is to buy a home without help.”

“We were not madly in love with the home because it needed a ton of updating. I wanted a house that was move-in ready. We also wanted to live within a very specific section of Forest Hills, and the home was one block outside of it and further from the train than we originally wanted.

But we looked at it as an opportunity to stay in the community and make the dated home our own. That ended up working in our favor. The home was listed at $930,000, but needed a decent amount of work, so we saved almost $30,000 off the asking price.

It wasn’t all compromises. We knew we wanted a basement and two full baths—and the house had both.

Most importantly, it's a chance to build equity and generational wealth for our children. As the child of immigrants, I'm always worried about the amount of money we’ll be able to leave behind.”

“Our mortgage is high and the biggest monthly expense we’ve ever had as a couple. Our goal right now is to build up our savings account to prepare for emergencies, so I’m back on my buy-nothing craze. Putting down the $3 bread for the $2.49 bread kind of craze.

We’re also saving for repairs. We’d like to update our kitchen in a year and the bathrooms in two years. Eventually we’d love to add an outdoor deck and pool, as well as redo the basement and finish the attic. Lots of big dreams here, but one step at a time.”

Tanya Benedicto Klich is Senior Editor at Marie Claire where she manages the Money & Career section. Over the course of her 10+ years as a journalist she has overseen the coverage of female founders, funders, executives, innovators and more. Tanya was previously a Lifestyle Reporter for Forbes, where she worked at the ForbesWomen and Forbes Lifestyle verticals. She was also a Features Editor at Entrepreneur Magazine, and a former on-air reporter for NY1 News. Tanya is also a graduate of Columbia University Graduate School of Journalism where she specialized in business & economic journalism, and is an adjunct professor at the NYU Arthur L. Carter Journalism Institute. She lives in Brooklyn with her husband and two little sons. Follow her on Twitter: @TanyaKlich