The Billion-Dollar Path Forward

Women-led IPOs and M&As hit a record high in 2021. Are these leaders the key to reshaping and diversifying American corporate culture—and, more importantly, will they open the door for the next generation of female founders?

A lucrative merger. A landmark acquisition deal. A high-profile company’s initial public offering. Such capital-markets speak might conjure up images of a cluster of mostly male executives on the balcony of the New York Stock Exchange, overlooking the trading floor—also a sea of men in suits.

But when Figs went public on the NYSE in 2021, the scene was less about suits, more about scrubs.

Heather Hasson and Trina Spear launched the California-based direct-to-consumer (DTC) medical-apparel company in 2013 to build the “Nike or Under Armour for healthcare workers,” as Spear puts it. At first, investors dismissed them. The idea of designing and manufacturing scrubs sounded less than sexy. “Everyone was like, ‘Why do people care? They’re at the hospital getting blood all over themselves,’” recalls Spear. “But everyone wants to look good and feel good at their job.”

“RNs and neurosurgeons are the most important people in the world, yet they are dressing terribly,” she adds.

Hasson, who previously worked in fashion, created the first Figs prototype for a friend: a nurse practitioner whose scrubs were laden with defects like frayed edges and uneven sleeves. She designed a slim-fitting, anti-wrinkle, water-repellent, four-way-stretch medical apparel. Spear, who knew Hasson through mutual friends, worked in finance. She quit her job in New York City to follow Hasson to Los Angeles. The duo invested a bulk of their savings to get Figs off the ground.

By 2018 they’d raised $60 million in venture-capital funding. Behind the scenes, Figs was and remains a lean operation. “Everyone has a major impact here, no one is a cog in the wheel,” says Spear.

After a successful Series B, the cofounders began discussing different growth avenues and exit strategies. In business, an “exit” is not necessarily a way out, it’s a way forward. It’s when an entrepreneur sells a company’s ownership—partially or entirely—to investors or another business. An exit plan provides a way to lessen or completely liquidate an entrepreneur’s stake in their company and, if successful, earn a return on investment for themselves as well as early investors. As the U.S. Chamber of Commerce defines it: “It’s a plan that moves a business toward long-term goals and allows a smooth transition to a new phase, whether that involves re-imagining business direction or leadership, keeping financially sustainable, or pivoting for challenges.”

Stay In The Know

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

The two most common types are an initial public offering, or IPO, and an M&A, where a company can either merge with another or be acquired (i.e. bought) by one.

In business, an 'exit' is not necessarily a way out, it's a way forward.

For Figs’ next phase, the cofounders opted for an IPO. “There were many who wanted to buy us out but we chose to go public because we feel we are building an iconic brand,” says Spear. “Some people want to sell to capitalize on a moment to capture some gain, but no, we’re building a real business that’s fast growing and can do this for a long time.” In addition to giving early backers a return on their investment, the decision to go public would help Figs gain global recognition and expand overseas. “The best companies are public companies,” says Spear. “It forces you to operate at the highest level if you want to be the next Nike or Lululemon.”

When Spear and Hasson rang the NYSE bell on May 27, 2021, under the ticker symbol FIGS, they shared the podium with a diverse and mostly female crowd of a dozen healthcare workers. Outside was what Spear calls “a massive party” of nearly 100 more community members hailing from various frontline fields, including nursing and paramedics.

“These are not your typical influencers, these are our medical ambassadors,” she says. “We invited them, they came…It was 2021 and still very much the peak of the pandemic so it was a celebration of who they are; it really was not about us.”

But it was. It was the first IPO led by two female co-founders and co-CEOs (Hasson has since transitioned to executive chair), and raised nearly

$581 million upon its stock-market debut, at a valuation of about $4.5 billion. Figs was part of a cohort of female-led IPOs in 2021. In addition to an array of biotech and software ventures with at least one female cofounder, more familiar and consumer-facing companies also went public, including Jessica Alba’s The Honest Company, 23andMe, Rent the Runway, Poshmark, Nextdoor, Clear, and Olaplex.

Anjali Sud, CEO of Vimeo, was the first South Asian woman to list on the Nasdaq. The most notable IPO history-maker was Whitney Wolfe Herd, founder and CEO of Bumble. Then 31, Wolfe Herd was the youngest female CEO to take a company public, raising more than $2 billion from investors.

Whitney Wolfe Herd made IPO history as the youngest woman ever to take a company public.

In the U.S., the number of public listings with a female founder or at least one female cofounder more than doubled year over year to 48 in 2021, according to PitchBook data. A great record to set, to be sure, but women-led firms continue to make up a tiny sliver of the overall IPO market. Hundreds of companies debut on the stock market each year. Removing men from the co-founder equation, less than 10 women-led U.S. companies went public last year. According to PitchBook, all-women-founded exits in 2021 only accounted for 0.8 percent of the total exit value.

Unfortunately, last year’s momentum didn’t carry into the following year, as 2022 saw stocks tank across the board amid global market volatility sparked by high inflation, policy changes from the Federal Reserve, and geopolitical factors, like Russia’s invasion of Ukraine.

Tracy Sun, SVP of seller experience at social commerce site Poshmark, says she and her cofounders have learned how to maintain employee morale amid this market. “The hardest emotion that came from our public listing is the external pressure: Why did our stock go up or down even though we hit our numbers? We tell [our team], ‘Don’t look at the stock, just zoom out. [The stock price] has nothing to do with how hard we worked or how accomplished we are.’”

Sun, whose company started trading on the Nasdaq last year, adds, “I advise other female founders going through an exit to take time to learn and understand what they want from this process, then get feedback and learn more—but don’t outsource your vision to swings in the market, investment bankers, or lawyers. This is your company.”

Figs cofounders Heather Hasson (left) and Trina Spear on the day of their IPO.

Spear agrees. “If you focus on the events of the exit, you’re missing the opportunity to build something special. Focus on the product, focus on community. Everything else is the result.”

Despite the seeming spike in IPOs, acquisitions continue to be the most common exit type for women, realizing more than $9 billion for female founders in 2021, according to PitchBook. The most notable was Sara Blakely’s Spanx, in which investment firm Blackstone acquired a majority stake for $1.2 billion, followed by Reese Witherspoon’s production company, Hello Sunshine, for about $900 million. Billie, Modern Fertility, and Briogeo were also acquired in 2021. But the M&A market can’t claim equality either. According to a Harvard Law study, “not only are women underrepresented as CEOs, but few leaders in the corporate development teams responsible for executing M&A transactions are women.”

More women at the deal table can perhaps obliterate the traditionally male-led and Machiavellian nature of “The Art of the Deal.”

When Vestiaire Collective, the Paris-based luxury resale platform, acquired California-based Tradesy in March 2022, it was a unique moment for the female-founder community, with women leaders on both sides.

“In a way, what Sophie [Hersan], Fanny [Moizant], and I are doing here is pioneering new ways of what it means to be in the same business category,” says Tradesy founder Tracy DiNunzio of the Vestiaire fashion director and president, respectively. “How do we collaborate instead of compete? I believe competition comes from a scarcity mindset; the idea that there’s not enough. What we have is a more feminine type of leadership that rejects the idea of having to cut each other down, and instead [we] lift each other up to benefit our teams, investors, and customers.”

DiNunzio adds: “When we first thought about collaborating, we weren’t thinking about M&As; it was more about how to accelerate the mission and the global fight to end fast fashion.”

Lakshmi Balachandra, Ph.D., is an associate professor of entrepreneurship at Babson College and science and technology policy fellow at the National Science Foundation. She says we’ll never achieve true gender parity in the IPO and M&A markets until we systematically break down the early-stage barriers that women face for funding; the very capital required to ultimately scale to late-stage success.

Tracy Sun cofounded Poshmark, which started trading on the Nasdaq last year, under the ticker symbol POSH.

In 2021, companies founded solely by women raised just 2.4 percent of the total capital invested in venture-backed startups in the US—a number that has barely budged over the past two decades.

When disgraced WeWork leader Adam Neumann raised $350 million in seed funding for his new real-estate venture—from major firms like Andreessen Horowitz—earlier this year, female founders were infuriated. His previous mismanagement and toxic leadership at WeWork resulted in a failure that has been the subject of books, business-school case studies, even a miniseries on Apple TV+.

Scores of female founders took to social media, incensed that their profitable and promising businesses struggled to garner attention from Silicon Valley investors. “I’m so tired of hearing women have to pitch differently and act more masculine so they finally get funding, only to face backlash when displaying masculine traits,” says Balachandra, whose research is focused on gender norms in investor pitches. “BFD is what I say to that.”

The root problem is entrenched gender bias. Says Balachandra, “When I worked in VC we would be biased against childcare businesses, which is ridiculous because it’s an enormous opportunity—everyone needs it. These places are underfunded because of the masculine preferences of those who are making the investment decisions.”

Until real change comes about, Spear advises women founders at any stage: “You have to believe in yourself.” To avoid sounding clichéd, she elaborates: “That means going against the grain and doing things differently. A lot of investors gave us advice that didn’t make sense, like go wholesale.” But Spear and Hasson stuck to their guns; DTC was the only way Figs could tap the medical community and innovate products according to their feedback.

This commitment to solving a problem and serving a community is what ultimately led them to their historic day at the NYSE and continues to drive them long after ringing the bell. “It was about getting the world behind our healthcare community and giving the healthcare professionals more of the spotlight, that was what our IPO was about,” says Spear. “It’s the beginning, not an exit, not the end, in any way.”

This story appears in Marie Claire's 2022 Power Issue, on newsstands November 22.

Tanya Benedicto Klich is Senior Editor at Marie Claire where she manages the Money & Career section. Over the course of her 10+ years as a journalist she has overseen the coverage of female founders, funders, executives, innovators and more. Tanya was previously a Lifestyle Reporter for Forbes, where she worked at the ForbesWomen and Forbes Lifestyle verticals. She was also a Features Editor at Entrepreneur Magazine, and a former on-air reporter for NY1 News. Tanya is also a graduate of Columbia University Graduate School of Journalism where she specialized in business & economic journalism, and is an adjunct professor at the NYU Arthur L. Carter Journalism Institute. She lives in Brooklyn with her husband and two little sons. Follow her on Twitter: @TanyaKlich

-

What to Know About the Cast of 'Resident Playbook,' Which Is Sure to Be Your Next Medical Drama Obsession

What to Know About the Cast of 'Resident Playbook,' Which Is Sure to Be Your Next Medical Drama ObsessionThe spinoff of the hit K-drama 'Hospital Playlist' features several young actors as first-year OB-GYN residents.

By Quinci LeGardye

-

Duchess Sophie Stepped Up to Represent King Charles at Event Amid Calls for King Charles to "Slow Down"

Duchess Sophie Stepped Up to Represent King Charles at Event Amid Calls for King Charles to "Slow Down"The Duchess of Edinburgh filled in for The King at the Royal Military Academy Sandhurst.

By Kristin Contino

-

See the Top-Scoring WNBA Draft Looks

See the Top-Scoring WNBA Draft LooksThis year's rookie class came to win.

By Halie LeSavage

-

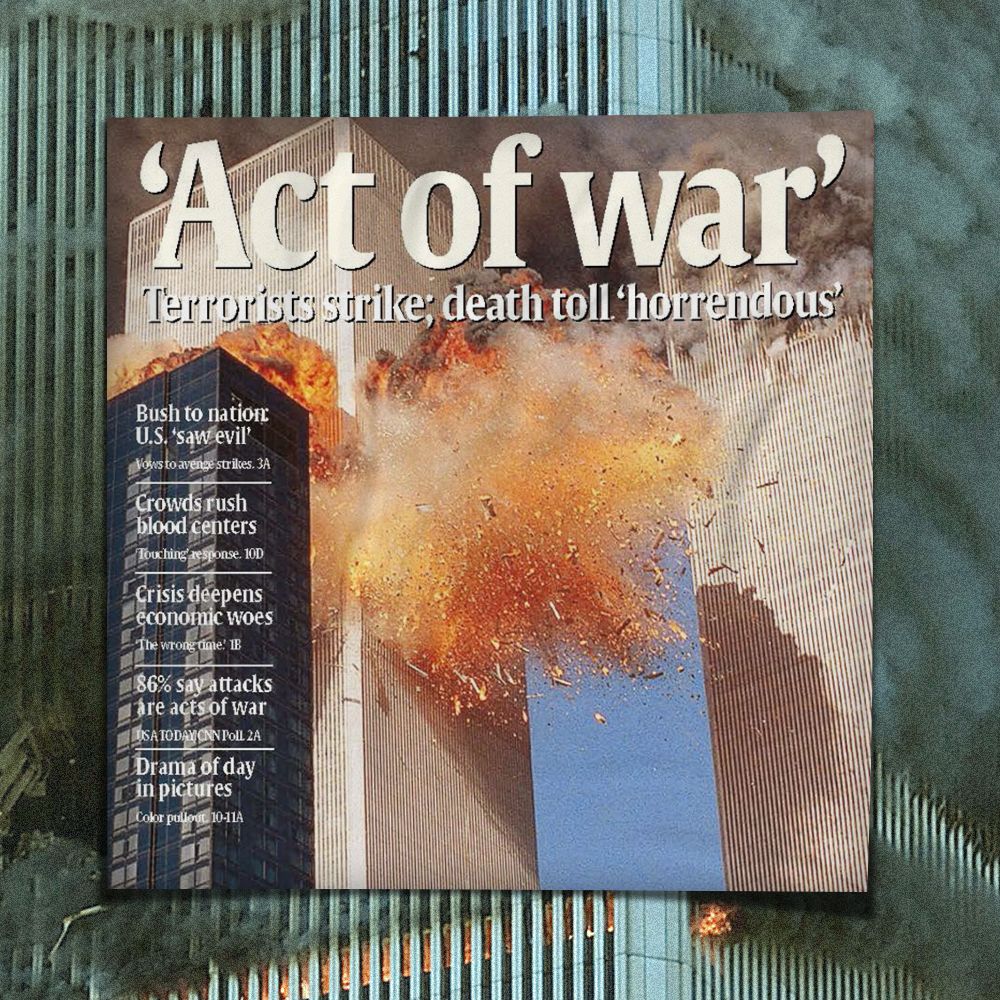

Inside the 'USA Today' Newsroom During the 9/11 Attacks

Inside the 'USA Today' Newsroom During the 9/11 AttacksSusan Miller, then the news copy desk chief, watched smoke billow past her office windows. She decided to keep working anyway.

By Rachel Epstein

-

Quibi CEO Meg Whitman on Starting a Company During a Pandemic

Quibi CEO Meg Whitman on Starting a Company During a PandemicThe head of the new video-streaming service—which launched yesterday—shares how they are pivoting their business because of coronavirus (plus, offers us lessons from her impressive career).

By Megan DiTrolio

-

Google's Chief Sustainability Officer Kate Brandt Is Making Data Centers More Efficient

Google's Chief Sustainability Officer Kate Brandt Is Making Data Centers More EfficientYou have data centers to thank for Netflix binges and to blame for Tinder ghosting: They run the internet. But they also are endangering our environment. Kate Brandt is working to change that.

By Megan DiTrolio

-

Male Coders Who Drop Out of College Are Heroes in Silicon Valley—but What About the Women?

Twentysomething women are bucking stereotypes by dropping out of school to make it in tech. But whether Silicon Valley will embrace their ambition or eat them alive remains to be seen.

By Diana Kapp

-

There Are People in the World Who Get Paid to Watch Netflix

There Are People in the World Who Get Paid to Watch NetflixBut there's a not-so-fun catch.

By Megan Friedman

-

What Silicon Valley Gets Right About Women and Motherhood

What Silicon Valley Gets Right About Women and MotherhoodNetflix, IBM, Google, Apple—the tech giants are making waves for working moms. Why won't Corporate America follow suit?

By Jesse Draper

-

Tech Influencers: The 3 Women Changing Everything

Tech Influencers: The 3 Women Changing EverythingIn an industry notorious for its buzz, bros, and billions, a new crop of whip-smart women is taking its rightful place at the top.

By The Editors

-

How to Get a Job at Vevo

How to Get a Job at VevoFeatures If music is your passion, listen up.

By Melissa Bykofsky