The Two Moms Who Took a Year Off to Travel—Then COVID-19 Happened

Every other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who decided to travel full-time just before COVID-19.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, a couple will get candid with Marie Claire about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

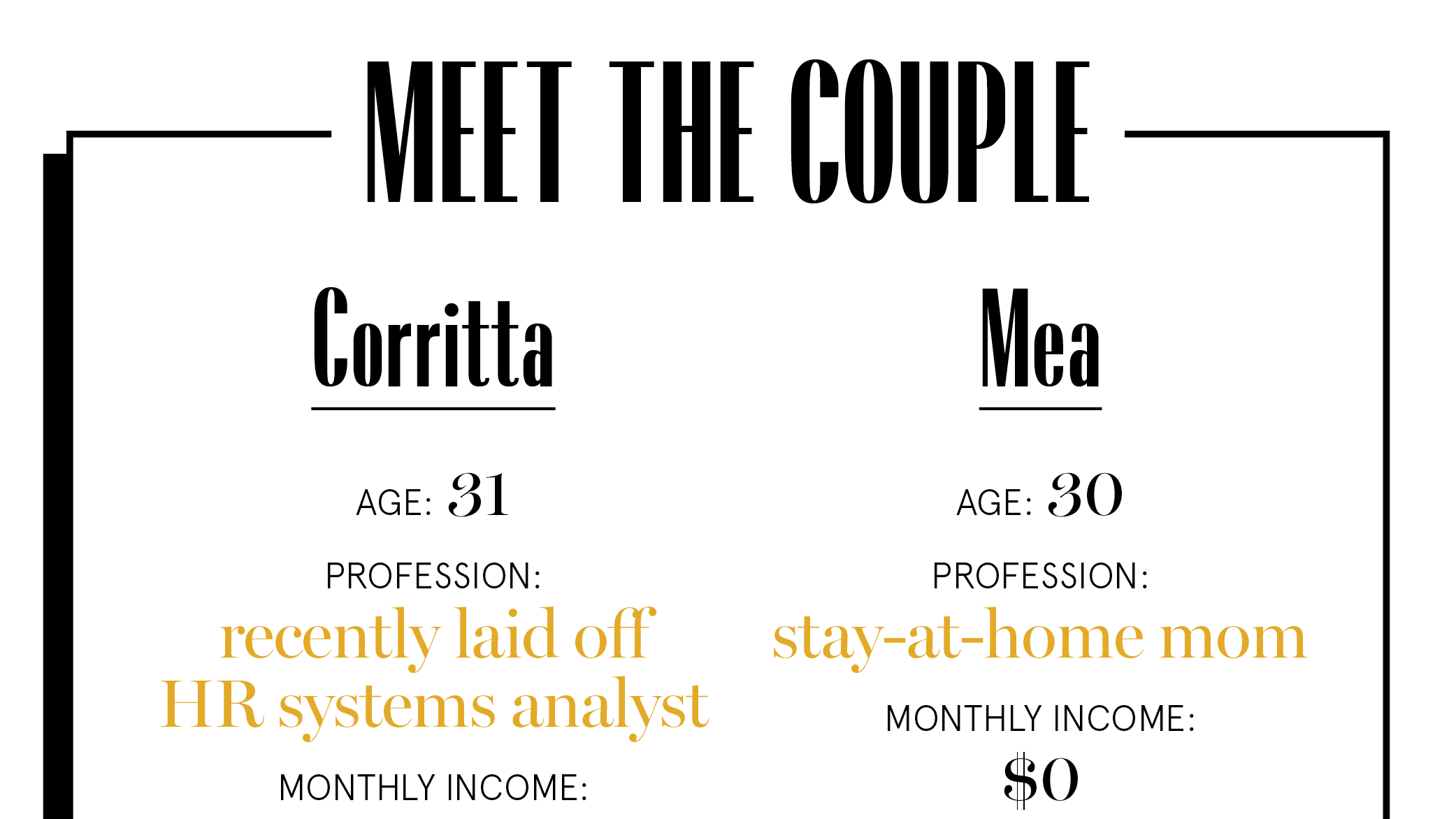

This week, we're talking with Corritta, 31, a recently unemployed HR system analyst, whose former salary and current three-month severance is $89,000 a year ($7,416.67 per month) and her wife, Mea, 30, a stay-at-home mom. They're both the founders of travel blog It's a Family Thing. They've known each other for 16 years and have been together for over three. After COVID-19 began, they quarantined with Corritta's sister in Colorado Springs, Colorado.

[Editor's note: At the time of the original interview, Corritta had not yet been laid off.]

How It All Happened

Corritta: We met in high school—we actually really don't remember, but I'm guessing 2004. I moved to California and we'd keep in touch throughout the years on Facebook and MySpace. In 2016, we finally reconnected.

Mea: Somebody reached out to somebody, we'll never know because neither one of us will admit to it. It was just a friendship-based thing and then it...turned into marriage and a baby!

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Corritta: She was in Ohio, and we just figured, "You should move to California." We've been together ever since.

Life Before COVID-19

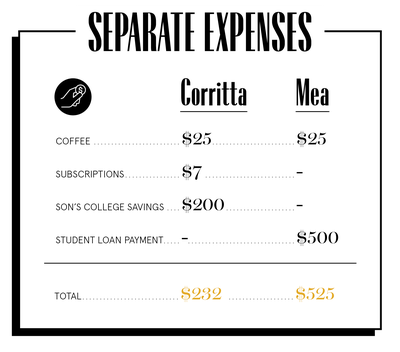

Mea: When we lived in California, I couponed. I didn't have to buy anything for a year and a half: toiletries, deodorant, laundry detergent, toothpaste, cotton balls, or Q-tips [because of the ability to extreme coupon]. My budget now for personal items is still only $153 because I know when and how to buy. I also love to teach, so sometimes I'd tutor children or babysit.

Corritta: We got married at the courthouse in 2017. Our big gift to ourselves was using the money we would've spent for a trip to Thailand and Japan. We were just blown away by how other people were so happy with so little. After that, we decided that we didn't want to continuously wake up and fight traffic and be unhappy. I don't hate my job but it's not ideal. I went back to work seven weeks after giving birth and I felt horrible about it. I decided, "We'll find a way where we can really watch our son grow up." I was getting to spend two hours a day with him and that just broke my heart.

How COVID-19 Impacted Us

Corritta: When we decided to leave San Diego to travel in January 2020, I resigned from my position. We'd started our travel blog in May 2019, and the plan was to work on it full-time. I have an amazing boss who asked for to me continue working remotely instead. We were supposed to go to Mexico [and eventually Central America and Asia], and we decided at the last minute we'd go visit my sister in Colorado in late January. Then coronavirus hit. That changed everything. We were having a hard time getting refunds from travel companies; We initially lost close to $2,000 in reservations, but recovered $1,500 thanks to Mea calling and following up with companies. My sister's expecting, so we haven't left the house. We get our groceries delivered and we buy almost everything on Amazon. I think we've been out of the house three times in two months.

Mea: Now we pay full price for stuff and it makes me sad [because I can't physically go to stores to do couponing right now]. A lot of the stuff that I couponed I'd give to women's shelters, like makeup kits. I used to be able to get food for $0.03, now it's a $1 a night, which adds up. Tutoring, even on Care.com, isn't an option so making a little extra with things I like to do isn't an option, either.

Corritta: Our son's always been a happy kid, but he's so much happier now. He just has a blast all day. He sits and watches Elmo next to me while I work, and it's amazing.

Our Dependents

Corritta: Just the two of us and our son, and we try as much as we can to help other people. We've been purchasing groceries for people anonymously during the pandemic. We've donated a couple hundred dollars to a few people on Facebook having a hard time. I actually don't know their names. We invited people to send us a message if they're struggling, they give us their Cash App, and we send the money.

Mea: I send my grandmother food and other stuff she needs—she lives in a nursing home.

When We Told Each Other Our Salaries

Corritta: Before we started dating. Our first conversation was very open. We discussed whether we were spenders or savers. We're both savers, which is good. She's kind of a super-saver, but we were on the same page.

How We Handle the Cost of Living

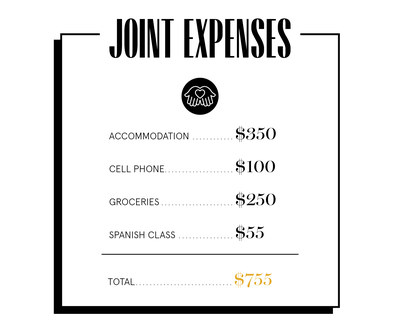

Corritta: At my sister's we pay utilities and we buy all of the groceries in exchange for not having to pay rent. When we travel, we treat Airbnbs as rent, then we treat going out to eat as our grocery budget. Flights are our transportation budget. It's a lot of moving parts.

Mea: She's the spreadsheeter, that's what I call her in my head, and I manage the breakdown of the budget. She does the big things, "This goes to the Roth account." I say, "I'll buy A, B, and C." If I have $50 in my account I'm already budgeting it. It all has to have a home.

Corritta: I can't help myself. I can't live without my spreadsheets.

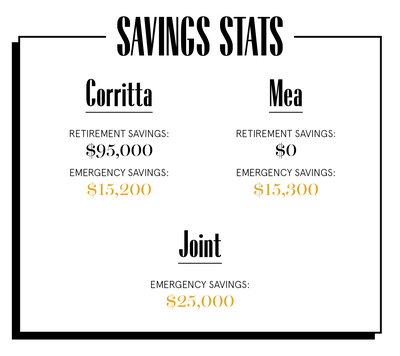

Why We Have Joint Accounts

Corritta: Everything goes into our joint account, but we have individual accounts that we co-own as well. When I get paid, the money goes into my checking account and I have regular transfers set up to move money to Mea's account. Then, we have allotments to go into our son's savings account. It's the easiest way to manage because our expenses vary.

Mea: We both said, "This is what I'm good at," and then there was no reason for us to overstep boundaries. It just works.

How Often We Talk About Money

Mea: It seems since we're going through all of this craziness that it's been a lot more often, especially because we're in a weird place of not knowing what's going to happen. What's our next move? We need to make a couple of different plans.

Corritta: We don't have that many expenses anymore. The biggest thing now is making sure we don't overbuy for our son—the clothes are so cute, you can't help it.

Mea: [Laughs] That's not a thing for me. But I'm Supermom, so I'm constantly trying to look up free ideas we can do.

How We Learned to Budget

Corritta: The biggest lesson I ever learned in my life was in college: My grandfather gave me $7,000 to pay tuition. At the time, they said I only owed $1,000 and I said, "Great, I have $6,000 to spend," and I blew it. I don't even remember what I bought. The next semester came and they told me I owed $3,000. I didn't know they billed per semester. I couldn't go back to my granddad and tell him, so to make up for that, that summer I worked two jobs. I worked at Target 4-11 a.m. And then I worked as a janitor 5-9 p.m. six days a week. I just barely made the deadline by three days.

Mea: A lot has happened with my little bit of life, but in college I realized that I was on my own. So I started learning how to coupon. I thought, "I have to find a way to either make more money or spend less money," and realized I needed to do both. I had a roommate move out on me and had to cover the cost. So I started budgeting like crazy and just learned how to do hair, babysit, and manage my time.

Our Biggest Fight About Money

Corritta: It's how we approach paying off debt, because I'm very aggressive. I hate owing anyone anything. I take care of all the credit cards, anything that's outstanding, and then she likes to approach her things in her way.

Mea: I understand cutting expenses to pay off debt, but they'll eventually get paid. You shouldn't have to eat crackers for two years! Sometimes stuff like that steals from moments of joy. I'm like, "Whatever it takes, but I'm not going to be sad for two years. Let's make it three years to pay this off."

How We Pay For The Non-Essentials

Corritta: Something we took into consideration was volunteering in exchange for accommodations, so we've reached out to a couple families. We're waiting to see when places reopen if in exchange for teaching English, creating websites, or babysitting, they'll give free lodging.

Mea: She usually picks out wherever we're going to stay. I create the outline of how we're going to save money to do whatever else we want to do.

Corritta: Even with the quarantine, we went to Garden of the Gods [1,300 acres of sandstone formations] in Colorado Springs, and we socially distanced there. Our son just loves being outside, he's a nature kid.

What We're Banking On

Mea: College or whatever our son chooses to do. Making sure all debt's paid off. In the future, buying a home and still traveling. Investing in ourselves and our businesses.

Corritta: We started another blog, My Eco Flow, in March 2020, which has ballooned into something bigger. It's all about sustainable menstrual products. Brands have sent us some products; We plan on launching a nonprofit to help combat period poverty. We're hoping maybe it can become another way for us to make income, but now it's just a huge passion project.

[Editor's note: Mid-summer, they re-launched distanced traveling and are currently in Playa del Carmen, Mexico]

Corritta: We're now living off of the severance I received from my job. I've applied for unemployment, but it will be several months before I receive my first payment. When the severance money runs out, we'll use our savings. Since being laid off, our travel blog has started to make money—it's doubled in revenue since July. (We're currently making $300 a month from Amazon, with no advertising, and our traffic is growing with 3,000 page views per month). We're looking forward to the continued growth, and hopefully financial security, our blogs will bring.

Interviews have been condensed and edited for clarity. Reporting and editing by Katherine J. Igoe. Design by Morgan McMullen.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.