Millennials Are Generation Broke—Here's How We Fix It

The class of 2019 is the last of millennials to graduate college, and they have a challenging financial future in front of them. But millennials will also be the ones to solve these systemic problems.

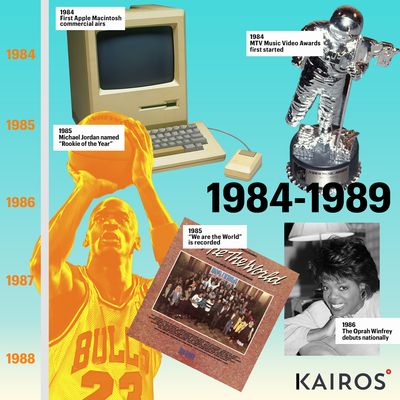

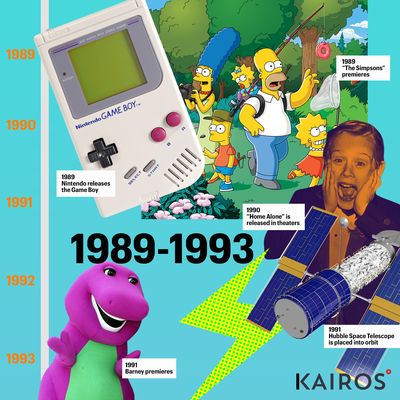

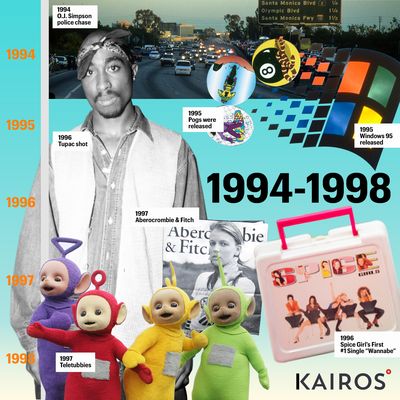

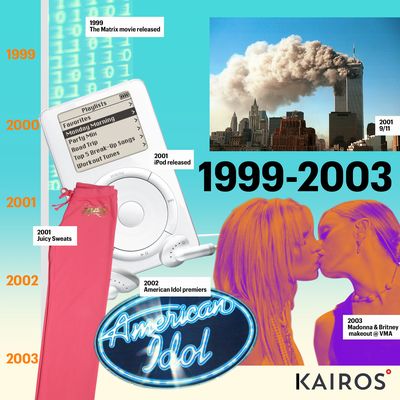

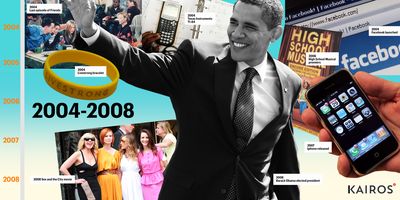

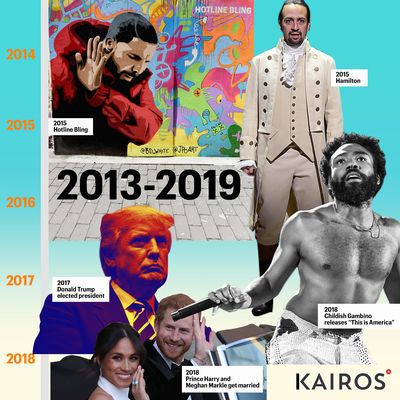

Well, class of 2019, it's official: You're adults, in some official sense of the word. Over the next few weeks, if you haven’t done so already, you’ll walk across a stage, shake hands with your dean, and smile for the camera. It’s a ritual that has continued for decades, but there’s something special about your class: You’re the last of the millennial generation to graduate college. Us elder millennials stayed up late hogging the family phone line, downloading N’Sync on Napster, and chatting on AOL Instant Messenger. Your class, the final millennials, has been sliding into your friends’ DMs since high school and never knew a world without Bieber. But, together, we share a total bafflement of Gen Z’s obsession with Tik Tok and complete misuse of the word Yeet.

I imagine you'll hear from some very accomplished commencement speakers, telling you that anything is possible if you follow your dreams and never quit—and that’s true. You’ll have opportunities that no generation before us has had, but you will also be facing an unprecedentedly challenging financial future. At some point after the adrenaline rush subsides, you might find yourself trying to figure out how to balance your mountain of student loan debt and new, astronomical living expenses, and I’m writing to assure you that you’re not alone. All millennials were born into Generation Broke, and today, I want to share some ideas for what can be done about it.

Boomers only had to work 306 hours at minimum wage to pay off a 4-year college tuition, our generation has to work 4,459 hours to do the same thing.

Older generations will take every opportunity to tell you that this economic struggle is somehow your fault, that you are “entitled” or simply spending your money poorly. But the truth is, we can do everything the “right” way—go to college, get a job, show up to work—yet unlike our parents or grandparents, we just can’t seem to get ahead. Where our parents could save enough for a home after just two years of renting, it takes us more than six years. And while boomers only had to work 306 hours at minimum wage to pay off a 4-year college tuition, our generation has to work 4,459 hours to do the same thing?? You’re choked by student loan debt, you give up half of your income on rent, you can’t really afford health insurance, and you definitely don’t have the money to start a family. What happened?

The primary reason millennials are the least financially secure generation in a century is that over the past few decades the cost of living has skyrocketed, but our wages haven’t. Even though the economy is technically still growing, most people in our generation aren’t seeing the benefits. If you look at the state of millennials today, nearly 50 percent of us have zero savings; almost 70 percent of us can't afford a $1,000 emergency expense. We’re on track for the worst income inequality in generations, and it’s not even our fault to begin with.

The expenses that hurt us the most—rent, healthcare, student loans, child care—are all the result of outdated industries that have become incredibly out of touch with the realities of our generation. As this election cycle gears up, we'll start to hear promises from 2020 candidates that they have a solution to fix these financial woes. Elizabeth Warren has announced that she will wipe out all of our student loan debt and make college free. Bernie Sanders has pledged to make our healthcare free.

It can be tempting to just sit back and wait for 2021, but you should know from experience that we can’t rely on elections going our way. As millennials, we have to be ready and willing to solve our own problems. By the time the next election is over, no matter who wins, the federal budget deficit will exceed $1 trillion, and student loan debt in the U.S. is projected to have already reached $2 trillion. We simply can’t wait to take action and we can’t count on any single politician to fix our problems. Our only immediate option when we encounter these broken systems is to create new business models that work for everyone now.

I’ll share a personal example: When renting an apartment, we’re required to pay an outrageous amount of money upfront. Landlords often ask for, among other things, first month’s rent, last month’s rent, and a security deposit. For a generation that barely has any savings, they may as well be telling us to hand over our first born child.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Our only immediate option when we encounter these broken systems is to create new business models that work for everyone now.

We could have waited for our government to fix this system, but instead a couple of friends and I worked on an idea that turned into a startup called Rhino. Together, we discovered that more than $45 billion of our generation’s hard earned savings are locked up in security deposits nationwide, and we came up with a solution that makes moving into an apartment far more affordable. Rather than tie up thousands of dollars when you sign a lease, we replaced the security deposit with a $5-per-month insurance plan. Renters are able to save money and landlords are still protected. In just one year, the concept has already saved people tens of millions of dollars. Think of suddenly having that $1,200 security deposit back in your checking account; $1,200 could translate into months of student loan payments or an emergency fund for healthcare costs.

What else can we solve together? In the coming years, you’ll probably find your Instagram feed evolving from graduation photos to engagement photos to baby photos—80 percent of new parents are millennials. And when (or if) you decide to take that leap, you might be faced with a very difficult decision: Stay in the workforce and try affording child care or keep one partner at home to raise the kids. The terrible irony is that child care can cost as much as your whole post-tax salary. The tightrope walk continues. But we can fix this.

As a generation, we need more bold attempts to turn the odds back in our favor. Our workforce is set to be 50 percent contractors by 2030; can we create a new benefits system for a new-age workforce? The median down payment on a home has increased to $20,000; can we turn months or years of rent payments into the down payment for future home ownership? Can we tie college degrees to future income so we aren’t drowning in student loans?

We cannot be afraid to fail, and we will need a relentless entrepreneurial spirit to continue creating shots on goal. To help do our part, my partners and I at Kairos have been focused on building more solutions to student loans, healthcare, childcare, and housing costs. In addition to getting rid of security deposits, we are creating a housing network to save people hundreds a month on rent. We are creating a membership to help new families save thousands of dollars on child care, and a delivery service to provide working parents with affordable, nutritious baby food right to their door. I tell you all this because I want you to know that many of us are trying, and you have allies amongst the ‘elder millennials’ too.

Millennials are the most entrepreneurial generation. Together we can use the same spirit of creative ingenuity to come up with real solutions to the crazy costs of living, so that they give us feelings of excitement rather than doom. If more of us do so, there’s a future in which we don’t have to automatically write off the idea of buying a house because we can’t afford it, and in which we can actually envision making enough to start putting money into savings. Together, we can create businesses that will bring down these insane costs and provide not just our generation, but future ones as well, a path to unprecedented economic prosperity.

Millennials: This Is Everything That's Happened In Your Generation

Ankur Jain is the Founder and Co-CEO of Kairos, working to make housing, student loans, healthcare, and child care more affordable. He was previously the VP of Product at Tinder.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORY