The $260,800 Expat Couple Who Prioritize Experiences Over Things

The latest edition of Marie Claire's 'Couples + Money' series.

Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

This week, we're talking with Sofia, 32, a journalist and writer who earns $98,952 per year ($8,246 per month), and her husband, William, 32, an engineer, who earns $161,916 per year ($13,493 per month). They've been together 12 years and live in Copenhagen, Denmark.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Sofia: We met in Milwaukee, Wisconsin, at Marquette, in September of my junior year and his first senior year.

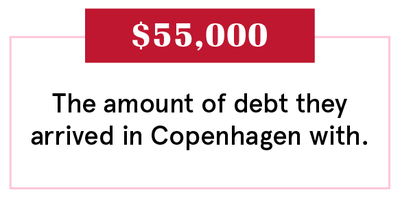

William: I was on the five-year program with my engineering degree. So, we graduated at the same time in 2009. In late 2013, when we were living in New York, I found out about this opportunity to move to Bangkok to open an office for manufacturing overseas—they wanted us to move in 12 weeks. So, we decided that we were going to get married before we went. Sofia pulled a miracle: In eight weeks, she was able to pull together a picture-perfect wedding.

Sofia: We've been expats now for five years, first in Bangkok, then in Copenhagen.

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Our Dependents

William: Our dog is the best. We got him when we were in New York, five months before we found out we were moving. We jokingly refer to him as our engagement puppy.

Sofia: There's never any consideration for what the dog might cost us. He's not expensive.

When We Told Each Other Our Salaries

Sofia: We've always just been so transparent with each other. I think part of that is when you meet at 21, no one has money, and so it's not like the haves versus the have-nots. It evolved in a really natural way.

William: Living in New York when you're younger and not making a ton of money isn't always the easiest. There would be a loan here or there between each other.

Sofia: When William got the offer to move to Asia, we were sitting on the coach and William was like, I really hope they put "manager" in my title, and God, wouldn't it be amazing if we made $15,000 more. Then I remember jumping up and down together in the kitchen because they made him a director, and they were going to pay him $100,000, and they were paying for our apartment. I remember feeling like we were the richest people in the entire world.

How We Handle The Cost Of Living

William: We opened up a joint account before we moved to Bangkok so that we could handle our U.S. money. All of the foreign bank account stuff kind of fell to me. Because in Bangkok especially, it was only my name on it because of my work permit. And at first, it was just my salary.

Sofia: I handle all the U.S. accounts like credit cards, and William handles paying all our international bills, like cell phones, electric, and rent.

William: We have one bank account. And that's where everything gets paid out of.

Sofia: In Thailand and Denmark, we only get paid once a month, so we rearranged all of our bills so that everything comes out within the first seven days of the month.

Why We Only Have Joint Accounts

William: We're like one person. We're one entity.

Sofia: We knew that I would be giving up a salary for a while, and we'd kind of never counted on my money because it can be irregular.

William: I find it cathartic once every quarter to put down in an Excel spreadsheet. Okay, this is where all of our accounts stand. And these are our expenses, and kind of forecast out.

How Often We Talk About Money

William: Living in New York, I managed to get myself into some credit card debt. I was fairly mortified and quite embarrassed to have to 'fess up and talk about it. But then, talking about anything else is easy. And we had lots of conversations about how we wanted to go about paying off my student loans—which we just finished paying off this year, which was great.

Sofia: While a budget's not written down on paper somewhere, we're both aware of how much money we have. There's at least like a temperature check every month after William has paid the rent and stuff.

What We Don't Talk About

William: There's nothing money-related that we don't talk about.

Sofia: William can be kind of cheap. At times he'll say, I know it's the right thing to do to get the quality thing versus the thing that will break in nine months. He'll just tell me, spend what you need to spend and don't tell me.

William: I was actually a little stressed to check the credit cards. I swore that would never happen to me—I'm too smart for that. And of course, three years later you find yourself with $20,000 worth of credit card debt. Ever since then it's like: I don't want to look at this. If Sofia says she's got it, I'm happy not to pay attention to that. And on my end, I just make sure that the rent and the bills are paid. I never want to be in that situation again.

How We Learned To Budget

William: I don't know that anybody formally taught me budgeting. I was definitely very interested in it when I was a kid. I have this memory from the Boy Scouts of being fascinated by the finance merit badge: If you start saving when you're this age, you're going to be a millionaire by the time you retire. And I thought: I'm going to remember that. In college, I started following Ramit Sethi and his "I Will Teach You to be Rich." Then it all fell apart when I managed to get myself into debt. It just started to intimidate me.

Sofia: I grew up in a house where my parents were always transparent about money and taxes, savings, 401k contributions, and so on. And I've just kind of always been that way. Struggling to pay your rent sucks, and I rode the wave through that time of my life, but I am so glad that's all behind me. Hopefully forever. For me it's really important to spend the money on a financial planner, because it's like a security blanket for me.

Our Biggest Fight About Money

William: I'm totally happy to use the financial advisor. But I do think about the fees that are associated with that. And how much did that impact it overall? And so I think we butt heads a little bit there.

Sofia: It's absolutely something else. He was such a freaking cheapskates about hiring a mover when I moved from my apartment into his. I just wanted to hire someone and have it be done and he was like, no way babe, we're going to hire these guys on Craigslist. They were totally worthless—they started hiking up their rates in the middle of the afternoon. At the end of the day we spent as much as we would have spent calling all of our friends. He learned his lesson. That's the kind of thing where I just pay and have it done in a way that I know I trust, but whereas William would say, no, I'm going to do this myself.

William: I'm cheap. I'm getting better at not being cheap. I have a hard time spending a lot of money on a single item. But then I enjoy it once I do.

How We Pay For The Non-Essentials

Sofia: Some of those types of expenses that if we lived in the U.S., we would certainly have to incur—like paying for a car—that's where our money for travel comes from.

William: Travel is probably our largest expense, and it almost exclusively goes on the credit card because we get points. And we travel a lot, so we get a lot of points.

Sofia: William calls me appointer. One of my favorite hobbies is figuring out which credit card to use and which airline miles we're maximizing. We completely value experiences over things and for us that's how we spend our money and it's how we bond. We only give each other a birthday gift and an anniversary gift. We don't do Christmas gifts and, honestly, for the last few years, the anniversary gift has been a trip.

What We're Banking On

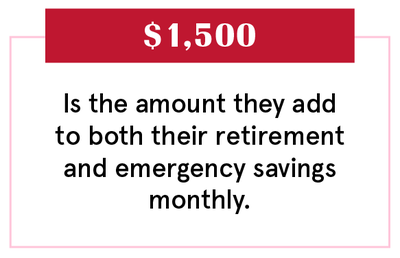

William: We have our IRAs and our non-IRA retirement account, as well as an extra savings account that we're starting to fund more now. Planning for retirement, planning for extra savings. We could imagine using that to buy a house or something in the five to ten year time horizon.

Sofia: We're saving for possible infertility treatments or adoption. But we are so far away from making a decision on that.

William: We've been here for six months in Denmark, and we quite like it. But I'm on a special tax scheme here that goes for up to seven years. Staying in Denmark beyond that would be a financial commitment and decision. So our plans are kind of fluid.

Sofia: We've had conversations about: Well if we really reined in the traveling, think of all the money we could save. That is really appealing on the surface but it can be a sacrifice to live this far from home, from our families. For us, the tradeoff is that we're able to be young and have these experiences together.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen. Animation by Hayeon Kim, Colin Gara, and Danny Ratcliff.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

Dedicated to women of power, purpose, and style, Marie Claire is committed to celebrating the richness and scope of women's lives. Reaching millions of women every month, Marie Claire is an internationally recognized destination for celebrity news, fashion trends, beauty recommendations, and renowned investigative packages.