How to Start a Company, According to Female Founders Who Did Just That

Last year, women launched 1,821 new businesses every day—yet, starting your own company can feel overwhelming. Here, everything you need to know to turn your entrepreneurial hopes into reality.

Have you ever had that aha moment, the idea sparked after realizing the way something is done now isn’t the way it should always be? That’s how many of the best businesses start. Sara Blakely’s billion-dollar Spanx brand began with a pair of cut-up control-top pantyhose she wore under white pants to a party. And long before Katrina Lake built Stitch Fix into a personal-styling platform worth about $3 billion, her friends collectively complained that in-person and e-commerce shopping was so tedious, so she thought, There has to be a better way. Turning that brilliant idea into a launchable business is where things get tricky—so with an assist from 20 entrepreneurs, investors, and execs, we’ve mapped out your path to becoming the next great founder and hustling your way to millions.

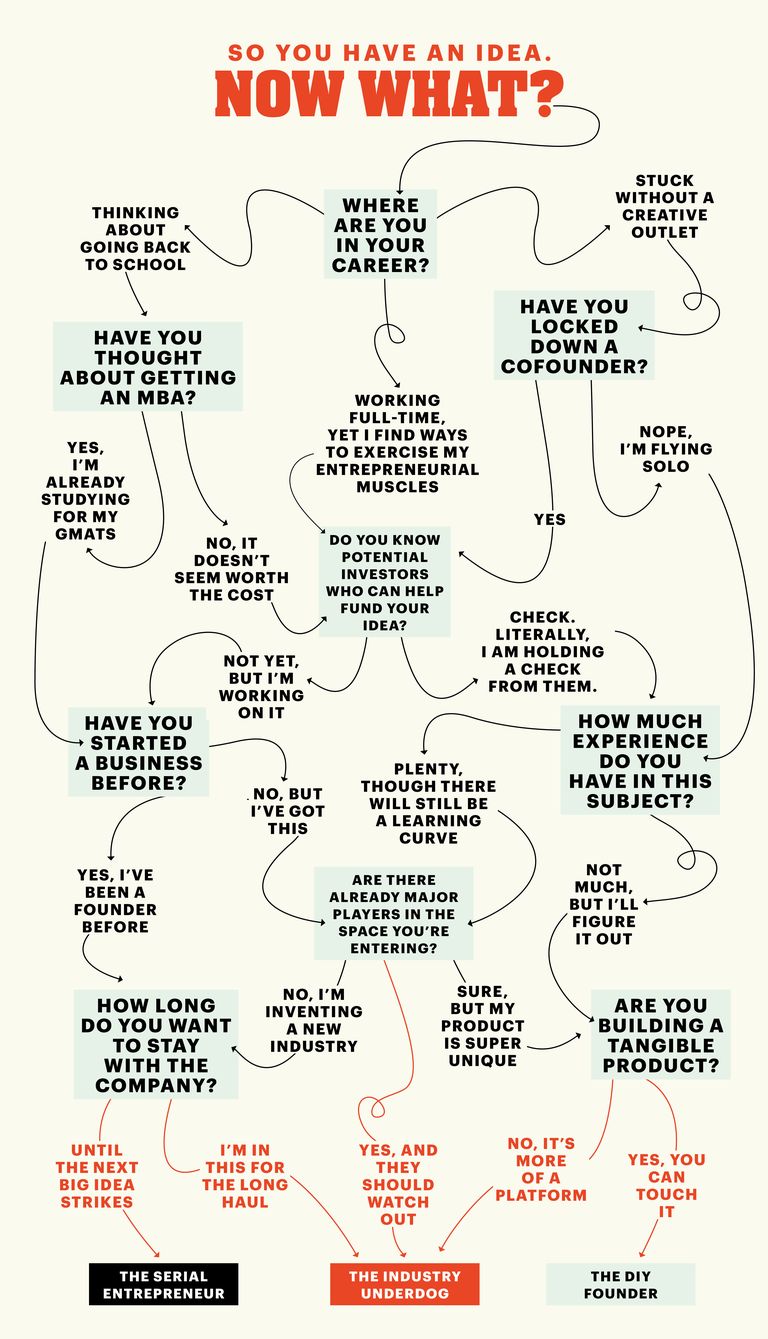

Find Your Founder Personality...

Jennifer Hyman: Cofounder and CEO, Rent the Runway

In startup land, there’s a lot of talk about a business plan—the blueprint for how you’ll build and scale your idea. Structurally, the document is simple. (Really. Google it and you’ll find countless templates to help you organize your mission statement, market analysis, financial projections, and the like.) What happens before putting pen to paper? That’s where the real work begins. Jennifer Hyman, cofounder and CEO of Rent the Runway, outlines the three things to do before defining your company’s future path.

Ask Yourself One Question

“Will I have fun every single day building this company?” It takes years of growing to hit your stride. If you don’t love your business and its mission, you’ll run into trouble.

Don't Have It All Figured Out

When we started Rent the Runway in 2009, we used early product tests to iterate* and define the correct strategy with the highest probability of success, then wrote the business plan. Once you set the business strategy, it’s difficult to change course.

Talk to Your Audience

We interviewed thousands of potential customers and dozens of designers to learn what value we could provide to both groups. These interviews became the foundation of our initial business plan. I still lean on those early learnings to evolve the company.

Think you don’t have the money to start a company? Think again. Sure, some entrepreneurs bootstrap*—but most launch with the help of other people’s money. Some routes require a way to recoup your partners’ investments. Others involve debt and interest rates. But all are an if/and—not an if/or. Below, the pros of each.

Equity Crowdfunding

Alexandria Tynion: Principal, SeedInvest

“Think of this like Kickstarter, but instead of a T-shirt, people get a stake in your company,” says SeedInvest principal Alexandria Tynion. Create fund-raising campaigns on platforms like SeedInvest or StartEngine—and once you’re approved, accredited or nonaccredited investors* can bet money in return for a small slice of ownership. “You don’t need to spend months chasing down a term sheet* or give up a board seat.”

Get exclusive access to fashion and beauty trends, hot-off-the-press celebrity news, and more.

Venture Capital

Theresia Gouw: Founding Partner, Aspect Ventures

Raising a venture round involves selling a percentage of ownership in your company in exchange for cash. Many companies take this route if their growth plans may outpace their bank accounts in the early days. These investors expect the company to eventually go public or to be acquired (see “Plan Your Exit,” below). Aspect Ventures founding partner Theresia Gouw says, “The average startup will partner with its first investor as a board member or adviser for eight to 10 years. Do your research to find who the best partner is for you.”

Bank Loan

Gwen Whiting and Lindsey Boyd: Cofounders, The Laundress

Gwen Whiting and Lindsey Boyd launched their detergent company, the Laundress, with $100,000 borrowed from a bank. “We wrote the business plan using my entrepreneurship textbook from college,” Whiting says of prepping for a loan* meeting. Their local Small Business Administration chapter guided them through the SBA loan application. “There can be complications when you add more people to the pie. Gwen and I split ownership 50/50,” says Boyd, an especially sweet split in the wake of their reported $100 million sale to Unilever.

Fintech Loan

Kathryn Petralia: Cofounder, Kabbage

Another loan option: Online lenders like Kabbage, cofounded by Kathryn Petralia. This appeals to founders hoping to raise a small amount of capital. (Petralia uses $50,000 as an example.) “Lots of women and minorities come to us. They like the anonymity of the process,” she says. “We focus solely on the data; we’re not biased by what we think a good business is.” Submit your company’s numbers and a loan application online in minutes. If approved, your information is organized on the platform, which helps manage your financials.

PRO TIP:

“Separate your business and personal finances. If you’re running your business out of your personal checking account, it’s harder to get a loan and increases your cost of personal borrowing.” —Kathryn Petralia

You have a solid business plan. That doesn’t matter if you can’t communicate it. So we asked three experts how to pitch.

How to Talk to Investors

Anu Duggal and Sutian Dong: Partners, Female Founders Fund

“Answer these questions: Why are you committed to spending the next 10 years on this venture? What are key levers at scale that will impact revenue growth*? Where do you want to be in five years? How do you see this growing to a $100-million-plus business? Can you convince others to buy into your vision early on?” —A.D.

“The goal of the first meeting is not to get a check but to get asked back to the next. Building relationships with investors happens over weeks or months, not minutes.” —S.D.

Listen to Your Customers

Heidi Zak: Cofounder and co-CEO, Thirdlove

“One of our first digital campaigns asked, ‘Ready to graduate from Victoria’s Secret?’ It caught women’s attention and still performs well. But over time, women wanted more depth and to see themselves in our ads. So in our recent photo shoot, we featured real women wearing the same bra across our entire range of 78 sizes. Talking to our audience has been an evolution, but the core message—inclusivity, acceptance, and body positivity—hasn’t changed.”

Your first idea isn’t always your best. Survival in startup land involves a whole lot of flexibility, and every iteration is unique to your company’s specific set of challenges. Three founders share how—and, most important, why—they altered course.

Where Your Customers Lead, You Follow

Sarah Flint: Founder and CEO, Sarah Flint

“Upon launching in 2013, we initially sold our shoes through department stores including Barneys and Bloomingdale’s. This was done to build a prestige brand. When you’re sitting on the shelf next to Manolo Blahnik and Hermès, it helps you get the Amal Clooneys and Meghan Markles of the world to pay attention. That structure, though, meant we had to price products from $495 up to $1,200. I looked at the way that people were interacting with brands and products— they were mainly shopping and engaging online—and I was selling at wholesale* to my friends and some of my best customers anyway. I thought, This is crazy. Why can’t I just offer this price to everybody? So we bought back our department-store inventory, and in the fall of 2017 we began selling direct to consumers through our website. Our shoes are now priced between $195 and $695, and we’re closer to our customer, interacting with them directly with a better understanding of what they want.”

Investors Don't Always Know Best

Mariam Naficy: Cofounder and CEO, Minted

“When Minted first opened in April 2008, we started by offering a large collection of wedding invitations from several well-known stationery brands and just a small handful of save-the-date cards from artists who won one of our first crowdsourced design contests. There was silence for a whole month, until sales started to slowly trickle in. It wasn’t the established brands that were selling but the designs by the contest winners. Before we launched, our investors were wary of crowdsourcing, so we’d thought it was going to be a small part of the business, not the business itself. But the only response we saw after launch was selling crowdsourced designs, albeit in small amounts—so we decided to pivot our entire focus to sourcing completely fresh, unique designs through design competitions. This strategy proved extremely successful in our first holiday season. After that, we moved away from carrying known stationery brands and now focus on selling only crowdsourced art and designs that are unique to Minted.”

You Can Make Money While Doing Good

Joanna McFarland: Cofounder and CEO, HopSkipDrive

“My two cofounders and I started our ride-hailing company, HopSkipDrive, in 2015 as a way to provide safe and dependable rides for families. It’s why all our drivers are fingerprinted and go through a 15-point certification process, including background checks and in-person interviews, to use our platform. Though we were branded as an Uber for kids, our mission was always about getting kids to reach their highest potential. When we learned there are federal mandates around keeping foster youths at their school of origin even if they move but cities struggle to find flexible transportation to match their schedules, we put in a bid in 2017 to provide transportation for L.A. county’s child-welfare system. Other counties started reaching out, and we’re now working with 160 districts and schools in California, Colorado, Virginia, and D.C. We’re removing mobility as a barrier to opportunity for underprivileged children—and as an added bonus, the enterprise side* of our business is growing almost 800 percent year over year.”

Jana Rich: Founder and CEO, Rich Talent Group

One of your greatest challenges as an entrepreneur is finding your team. It needs to have people who are game to take your calls at 3 a.m. when your site’s code bugs out, raise their hand to do everything from schmoozing with potential clients to taking out the trash, and act as an extension of your brain. Jana Rich, the founder and CEO of Rich Talent Group, advises how to recruit an early-stage crew that can help build your rocket ship when you have little money and even less time.

Hire People Who Complement Your Strengths and Weaknesses

If you’re better at external meetings and marketing, hire an operator to be internally focused. It’s natural (and smart) to bring in people you’ve worked with before and trust, but you also need to go beyond your inner circle; diverse teams perform better.

Look for Talent Magnets

If your budget is tight, hire people who attract other talented team members from their networks or previous jobs. They should believe in the future growth potential of your company and negotiate for more equity versus cash compensation.

Trust Your Gut

The strong performers on your team want to see that a high bar is being set. If it’s not working with one of your team members, address the issue directly and early, let him or her go with grace and humility, and then move on.

After years—and years and years—of strategizing and pivoting and scaling, many founders start to think about what’s next. Some entrepreneurs want to work 80-hour weeks for the rest of their lives (cough, Elon Musk, cough), while others realize that’s not sustainable. Whatever your goal, you have options.

Cash Up

Julia Hartz: Cofounder and CEO, Eventbrite

An IPO (or an initial public offering) is when a private company lists itself on a stock exchange—think NASDAQ or NYSE—and allows bankers, funds, and regular consumers to buy and trade pieces of the company, making them official shareholders. Founders who pursue IPOs with tactical skill stay plenty in control and allow their investors to sell their ownership stakes. It’s also a way to get way more funds to support growth goals—especially those expanding internationally—and raise a higher profile. Being listed on any stock exchange usually adds a level of credibility you don’t always get as a private company. One of the reasons Julia Hartz, CEO of Eventbrite, took her company public in 2018 was to raise money to expand the company’s global footprint, and “the discipline and transparency that being public demands keeps us focused on executing on the tremendous opportunity ahead of us, regardless of market cycles.”

Cash Out

Talia Frenkel: Founder, This Is L.

Another option? Getting bought. Talia Frenkel, the founder of sustainable tampon and condom company This Is L., sold her company to Procter & Gamble for a reported $100 million in February 2019. When P&G first reached out asking for a meeting, she didn’t think the conversations would go anywhere—it owns Tampax, one of L.’s biggest competitors—but the corporation surprised her. “They did not skip a beat about maintaining our public-benefit-corp status*,” she says. “Ultimately, L.’s purpose is to make essential products accessible to as many women as possible, and P&G presented the opportunity to scale that purpose to reach billions of people around the world.” Anyone with an ownership stake in the company (founders, investors, and sometimes employees) gets paid. Talia will remain an advisor of This Is L.—though plenty of founders leave their company or step into a role with fewer day-to-day responsibilities.

Keep Control

Tory Burch: Executive Chairman and Chief Creative Officer, Tory Burch

Sometimes, your exit strategy is no exit at all. Many founders prefer to maintain control of their company. Without swarms of Wall Street shareholders judging their every move, private companies face less pressure to meet short-term revenue goals and to keep costs tight. Despite rumor after rumor of a possible IPO, Tory Burch has been steadfast in her plan to keep the company private—and Eileen Fisher has been running her eponymous clothing brand since 1984, with no plans to sell or go public. That approach has allowed both companies to focus less on meeting investor demands and more on keeping their customers happy. Usually, private companies that have been in the game for a while have business models* that yield healthy revenue streams and, in most cases, profitability.

Jean Brownhill: Founder and CEO, Sweeten

As a first-time founder, you’re going to make a ton of mistakes on the road to figuring it all out. Jean Brownhill, whose contractor marketplace, Sweeten, launched in 2011 and has since raised over $9 million, looks back at her early days in entrepreneurship and shares what she wishes she realized earlier.

Get a Plain Navy Blue Dress

For some reason, it was the best outfit for me to pitch in. After A/B testing a bunch of options, the navy dress was hands-down the winner. Find your power outfit so you can focus on what’s really important.

Your Health Is Your Safety Belt

Being an entrepreneur is an extremely bumpy ride. Even when it’s going great and your business is growing, there will be problems. If you’re not physically strong and feeling good, you’re not going to be able to deal with the issues of your business. Go to the gym, get eight hours of sleep, eat good food, and try not to drink too much. It’s the only way to get through it all.

Hire the Team That's Right for You

In the beginning, I’d hire people I thought I “should” hire, mostly based on their technical skills. I then would try and contort my leadership style to work with them. This never works. People on your team need to be well-suited to work with you.

Do Not Meet Male Investors for One-on-One Drinks

Duh!

A handy tool to help you remember all the boring to-dos while you're busy building the next big thing.

1: Nail the Basics

What is your company’s mission—and its name? (For a fee, you can hire a firm to help.) Decide if you want a cofounder, though know solo founders are twice as likely to succeed as cofounders.

2: Fill Out All the Forms

You will get very tired of your own signature. Sign up for an Employee Identification Number, register as an LLC, map out licenses you may need, and download accounting software.

3: Brand Your Baby

You have the name; now you need the look. Whether you outsource creative or hire a UX designer, focus on crystallizing your vision. This will be your company’s introduction to the world.

4: Get to Know Your Market

What is your target audience? Who are your competitors? Once you nail down your user base, tweak your product, launch in beta (find users organically or through a firm), test, and tweak again.

5: Write Your Business Plan

It’s fine to keep things fluid early on but you’re 16 percent more likely to reach cash flow positive with a solid strategy than if you don’t have a formal outline.

6: Figure Out Your Finances

Explore the type of funding that fits your company’s goals. Do you have a high growth potential model and hope to eventually sell or go public? Then a VC route makes sense.

7: Launch!

You got this. Seriously. A recent study confirmed that women are better entrepreneurs than men. Startups with a female founder or cofounder made 10 percent more in revenue than companies with a male founder.

When things get hard, remember... this could be you:

Karissa Bodnar, Founder and CEO, Thrive Causemetics

“With a business plan I wrote on my iPhone and my life savings of $100,000, I launched Thrive Causemetics in 2015. Our first product was lash glue; I made it with my Vitamix in my kitchen, and we shipped all orders out of my one-bedroom apartment. By November 2016, we were selling about $1,000 worth of products a day. That turned into $100,000. Today, we sell one $24 mascara every nine seconds. My advice? Check your ego at the door and be willing to learn every hour of every day.”

Your Resource Guide

Because no one will judge you for asking for help

An earlier version of this article stated that Talia Frenkel would remain CEO of This is L. She is now an advisor.