Welcome to Couples + Money, where we break through the confines of polite conversation. Forget questions about your sex life. We're getting even more personal. Let's talk about what you and your partner are doing—and not doing—with your paychecks.

Every other Thursday, an anonymous couple will get candid with MarieClaire.com about how they split their finances. We’ll break down what each person pays for individually, what they split, and all the gritty details—from who picks up the bill in restaurants to who picks fights over bank statements.

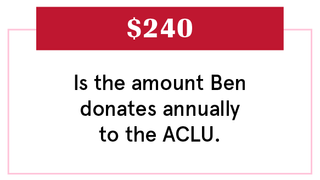

This week, we're talking with Becky, 27, a PR manager, who earns $80,000 per year ($6,666.67 per month), and her boyfriend, Ben, 30, a head of social media, who earns $115,000 per year ($9,583.34 per month). They've been together over two years and live in Brooklyn, New York.

Want to be profiled with your partner in Couples + Money? Get in touch: couples.money@hearst.com.

How It All Happened

Becky: We actually met on Tinder in April 2017.

Ben: We'd been talking for a little while on the app. We went to grab a drink at this place in Soho and started our "courtship."

Becky: We moved in together this past June. For me, I wanted to set expectations and understand, "Okay, what's after this?"

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Ben: We're very committed to each other, and we have plans well into the future. I think the goal would eventually be an engagement within the next year and a half.

Our Dependents

Ben: A dog. And I take the lion's share of that responsibility. We got him in January, but we were living separately at the time, and the decision to get a dog was mostly mine.

Becky: At that point we knew we'd be moving in together. I make way less than Ben, so I'm not in a position to pay for daycare. So if it gets to a point where the dog can stay home by himself and we just need a walker once a day, I'd happily volunteer to contribute to that.

When We Told Each Other Our Salaries

Becky: We didn't blatantly talk about money for a while. In the beginning, Ben would actually foot the bill for most of our dates. So I think the first time was once we started going Dutch with stuff, six to nine months after we started dating.

Ben: Last summer we first started to share information about each other's salaries and monthly budgeting process. Hers is a lot more organized and diligent than my process, which is pretty unstructured.

How We Handle the Cost of Living

Becky: This is the first time I've lived with somebody, and I thought out of fairness, Oh, 50/50 would be good. Hindsight is 20/20—and we did actually talk about that a week ago. I said, "I'm not going to ask you to renegotiate how we split the rent for this particular yearlong lease, but moving forward, if you're going to continue to make more money than me, it needs to be be more of a 60/40 split." Within the next year, it'll shake out in different ways with him covering more dinners, but for some of those more important expenses, that'll still be split 50/50.

Why We Don't Have Joint Accounts

Ben: I think it's working for us not having a joint account. I don't have any experience with even investigating if that'd be the right solution for us.

Becky: For me personally, I'd only do that once I'm married. So in the foreseeable future but not anytime soon, and even then, I might still want to have my own individual account for what Becky wants to get for herself.

How Often We Talk About Money

Ben: An informal conversation goes on maybe once a week, since we split everything. So there's always some passing conversation about money where she'll ask, "Can you remember to Venmo me for this meal/this ride?" But in terms of budget, the two of us, it doesn't really happen.

Becky: It's an unspoken exchange that we're good about having. It's almost like we can sense each other's vibe and we don't have to make it a thing. We just know how to react if we need to have a money conversation.

What We Keep Secret

Ben: I don't feel the need to tell her about the purchases that I make, and vice versa. In terms of finances, we both live pretty independently.

Becky: If we're talking about credit cards, I'll vaguely mention, "Oh yeah, I pay my debt all the time and I don't let it get to more than X amount." A lot of times it's substantially lower than his. Also, we both have student loans. I don't know how much he has remaining. I've brought it up, but it doesn't sound like he's going to be, or wants to be, done anytime soon.

How We Learned To Budget

Ben: It's an ongoing process. And I have work to do. My parents never taught me how to budget. This has all been stuff I've just picked up along the way. I usually have a number in my checking account that I'm not comfortable with dipping below. I just keep an eye on that number, and if I get close to it, then I'll ease back on spending. I'm at a stage where I'm more concerned with enjoying my life and living comfortably. At times, that'll lead to irresponsible spending. But there'll always be a point not long after where I take a step back, assess my finances, and make a plan a few months from that point.

Becky: Growing up, I just had a knack for saving money. Even when I had different high school jobs, I would have hundreds of dollars saved. I have a single mom who was never that great with money, to be honest. After I graduated college, she noticed how good I was with money. She read a finance book and taught me how to write out a zero-based budget. Anytime you get paid, you write down the total, and then you subtract in different areas that you spend. Entertainment. Transportation. Savings, of course, and then loans, until you get all the way down to zero. And then you have physical envelopes for every bucket, and you take out cash to put in the envelopes. Anytime I'd need to pay for an expense, I'd take the cash first before I swipe. Of course, my salary has increased, and I have more expenses. And now there are situations where I don't pay with cash. But to this day, six years later, I still write it.

Ben: I have a budget on the app Mint. And I very loosely follow that. I'm a real mess when it comes to handling money. I'm fortunate not to have to keep such close track of it. But I can't say for 100 percent certain if I spend X amount and on which areas of my life. I think Becky has taught me a lot in the way she budgets her money. It's made me become more aware of how I spend and save.

Becky: Ben knows I have this crazy system. He doesn't completely get it, but he knows it keeps me financially safe. He jokingly said, "When we do have joint expenses, this is going to be crazy." I'd never want to make somebody feel like they need to do that. However, I do think there should be some sense of awareness. When and if it does come to that point of joint expenses, I think maybe we'll do an Excel tracker. I'm willing to loosen the reins a bit, but I don't want to spend just to spend.

Our Biggest Fight About Money

Becky: We've never fought about money.

Ben: We haven't. I think we had some disagreements over things we've needed. We debated over what couch to get. I was pushing for a more expensive couch that met a few criteria of mine, and she was of the position that we didn't need that. She spent time doing research to find a couch that at least met some of my criteria, for much less.

How We Pay For The Non-Essentials

Becky: Usually we want the credit card points: "I'll take the flight on my credit card. You put the hotel on your credit card." And when we travel, I don't want to dip into my savings. Ben knows I'm going to pay him back. So I'll just say, "I'll send it to you when I get paid."

What We're Banking On

Becky: I'm looking at a trip for us in December, and going to parents for Thanksgiving.

Ben: A cross-country move is something that I have in the back of my mind, always, to have a cash reserve to pay for. Otherwise we're living in New York, struggling to bank enough money for any meaningful life investment like a house or car. We both have family in California. Becky loves the sun and the beach too much to be living in the Northeast. And I've always heard of how transformative of an experience it is to move from the East Coast to the West Coast. I feel like it's our turn to have that experience.

Interviews have been condensed and edited for clarity. Pseudonyms have been used. Reporting and editing by Katherine J. Igoe. Design and illustration by Morgan McMullen. Animation by Hayeon Kim and Colin Gara.

For more stories like this, including celebrity news, beauty and fashion advice, savvy political commentary, and fascinating features, sign up for the Marie Claire newsletter.

RELATED STORIES

-

Paris Hilton Is Finally Ready to Share Her Daughter With the World

Paris Hilton Is Finally Ready to Share Her Daughter With the WorldHilton shared why she chose the name London, who her daughter resembles, and the special significance behind her birthdate.

By Fleurine Tideman Published

-

Kim Kardashian Confirms to Jimmy Kimmel Whether the Weirdest Rumors About Her Are True or Not

Kim Kardashian Confirms to Jimmy Kimmel Whether the Weirdest Rumors About Her Are True or NotEmphasis on the WEIRDEST rumors.

By Fleurine Tideman Published

-

Cute Summer Outfits From the Runways With Real-Life Appeal

Cute Summer Outfits From the Runways With Real-Life AppealFrom beach bumming to al fresco dining.

By Emma Childs Published

-

Where Did All My Work Friends Go?

Where Did All My Work Friends Go?The pandemic has forced our work friendships to evolve. Will they ever be the same?

By Rachel Epstein Published

-

So You Want a Postnup

So You Want a PostnupNo, they’re not planning to divorce, yet more couples are facing the awkwardness of getting their marital finances in order—after they say “I do.”

By Emma Pattee Published

-

The Two Moms Who Took a Year Off to Travel—Then COVID-19 Happened

The Two Moms Who Took a Year Off to Travel—Then COVID-19 HappenedEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who decided to travel full-time just before COVID-19.

By Marie Claire Published

-

Warning Working Moms: Your Partner Is Your Glass Ceiling

Warning Working Moms: Your Partner Is Your Glass CeilingBestselling author and essayist Caitlin Moran warns in her new book More Than a Woman that a mother’s career is only as good as the man or woman she marries.

By Jo Piazza Published

-

The Unemployed Couple Squatting in Their Brooklyn Apartment

The Unemployed Couple Squatting in Their Brooklyn ApartmentEvery other Thursday, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who haven't paid rent on their apartment in months.

By Marie Claire Published

-

The Blogger Couple Who Made $20,000 When the Pandemic Hit

The Blogger Couple Who Made $20,000 When the Pandemic HitEvery month, a couple will get candid with Marie Claire about how they split their finances. This week, we're talking to a couple who lost revenue during the pandemic, but invested wisely.

By Marie Claire Published

-

The Couple Who Used a Health-Share Ministry for a $1,000,000 Surgery

The Couple Who Used a Health-Share Ministry for a $1,000,000 SurgeryThe latest edition of Marie Claire's Couples + Money series.

By Marie Claire Published

-

The $266k Couple Whose Wife Created an App to Track Their Spending

The $266k Couple Whose Wife Created an App to Track Their SpendingThe couple make $266,000 a year.

By Marie Claire Published